If you've been scratching your head over claims that housing is "more affordable than ever," you aren't alone and, given the most up-to-date report on home prices, more head scratchers could be joining you.

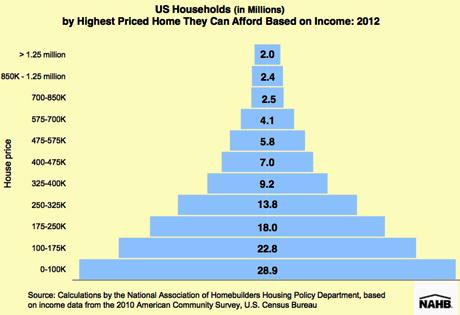

The majority of Americans can only afford homes that cost less than $175,000 and nearly one in three can only afford something for $100,000 or less, according to the National Association of Home Builders' (NAHB) "Priced-Out Effect" report.

During the housing crash, many markets did see home prices slashed by as much as 50 percent in some of the hardest hit areas, especially when foreclosed and other distressed properties were tossed into the mix. Unfortunately, household incomes tanked too.

Unemployment and under-employment have really taken a toll on the American home-buying psyche, unfortunately, at a time when home prices are relatively low and interest rates are at all-time lows.

The NAHB's Priced-Out study translates U.S. Census Bureau-American Community Survey household income data into the distribution of homes that U.S. households can afford homes in various price ranges.

The model estimates how many households can qualify for a new home mortgage before and after a house price increase. The resulting difference is the number of priced out households.

Displayed as a pyramid of affordability, with less-expensive homes at the base, the model reveals a crowded base where a large number of households have relatively modest incomes. As the price of a home goes up, the pyramid narrows, climbing with fewer and fewer households in each tier able to afford higher priced homes.

NAHB Pyramid

Based on conventional assumptions and underwriting standards that included a 10 percent down payment, it takes an income of about $26,430 to purchase a $100,000 home, according to the NAHB.

In 2012, about 28.9 million households in the U.S. are estimated to have incomes lower than that threshold and, therefore, can only afford to buy homes priced under $100,000.

Of the remaining 87.5 million who can afford a home priced at $100,000, 23.3 million can only afford to pay a top price of somewhere between $100,000 and $175,000.

Together, those who can afford housing priced at or below $175,000 make up nearly 52 percent of all households.

Toss in the $175,000 to $250,000 bracket, add the additional 18 percent of households who can afford that bracket and affordability for homes at $250,000 and below amounts to nearly 70 percent of households.

At the peak of the pyramid, where the 1 Percenters live, only 2 percent of households can afford to buy. Of course, the 99 Percenters could care less.

NAHB's pyramid could be only the tip of the iceberg.

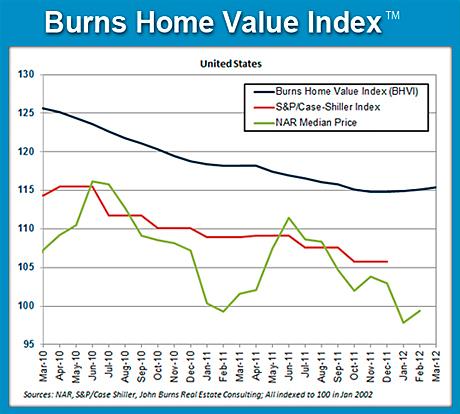

John Burns Consulting reported this week, if you've been following lagging home price trends reported by the National Association of Realtors, Federal Housing Finance Agency (FHFA), S&P/Case-Shiller and others (including NAHB's pyramid), if you are trying to monitor affordability with those reports, you might as well be on board the Titanic.

Burns Home Value Index

The "Burns Home Index" reveals home prices have been rising for three months in 90 of the 97 markets they track. Other studies show price improvements only in the last month.

Burns says the average price increase over the past three months has been 1.1 percent, an unexpected 4.5 percent annual rate.

"This is big news, so why isn't anyone else reporting it? It is because most price indexes are at least 3 months behind what's happening with home prices right now," says Burns' blogger Wayne Yamano.

__________________________________________________

Thanks. There's another spin on affordability coming out tomorrow or next Friday. Watch for it.

Thanks Donna. Keen observation. Do you know how much commissions have been cut?

great article Broderick. Everyone has been ignoring the fact that globalization and the recession have resulted in falling income levels for the majority of consumers. Builders in particular will have to adjust their building strategies for this in the future, and sale prices for existing homes won't be headed up much anytime soon. This is going to have a wide ranging impact on the real estate industry, which is used to working on commissions that are now well below what they used to be.