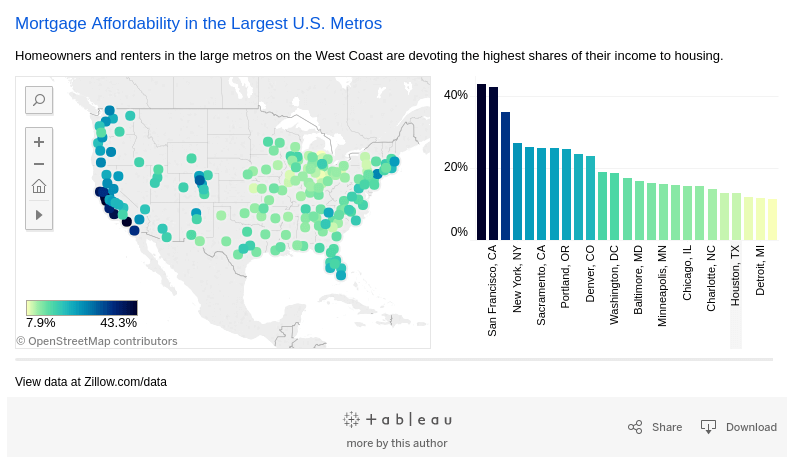

Mortgage payments in half of America's markets are unaffordable. Buying the typical home listed for sale in more than half of the nation's 35 largest markets will require a greater share of income than the median-valued home required historically, according to a new Zillow analysis.

One reason this home shopping season is so difficult for buyers is that the homes available for sale are generally more expensive than the median home value of all homes in the same market.

As home prices recovered and surpassed the peak values reached during the housing bubble, concerns about housing affordability also returned, despite low mortgage rates keeping monthly payments relatively affordable. The large down payments that come with high prices are a significant barrier to homeownership, and the monthly payments are taking up a larger share of income as well.

Nationally, mortgage payments on the median home for sale require 20 percent of the median income.

"Homes have gotten so expensive in many major cities that even with low mortgage rates, monthly costs for homes that are currently for sale are starting to be unaffordable," said Zillow Chief Economist Dr. Svenja Gudell. "Down payments are a top concern for today's homebuyers, but the reality is that monthly costs are becoming unaffordable as well. Low inventory is pushing sticker prices higher, and when mortgage rates start to rise, monthly payments will be driven further into unaffordable territory."

Los Angeles homebuyers have to spend the highest share of income on mortgage payments – the typical home for sale would require 46.8 percent of the median income. In the years leading up to the housing bubble, Los Angeles homebuyers would have had to spend 35.2 percent of their income on mortgage payments for the typical home.

Cleveland homes for sale are more affordable than homes were historically. The median list price of about $144,000 would require 12.7 percent of the median income for monthly mortgage payments. In pre-bubble years, paying the mortgage on the typical Cleveland home required 20 percent of the median income.

I'm lucky enough to have a home that is very affordable - around 13% of my after tax income. This enables me to save and invest much more money, which will eventually lead to even more money.

I wouldn't ever live where housing costs such ridiculous prices. If you are in a place like this, move. There are so many places in the country or world that are amazing.

I use my money to buy my freedom - not expensive housing.

A very sensible way of looking at things. I did the same by moving to Thailand where housing is MUCH cheaper than at home 🙂