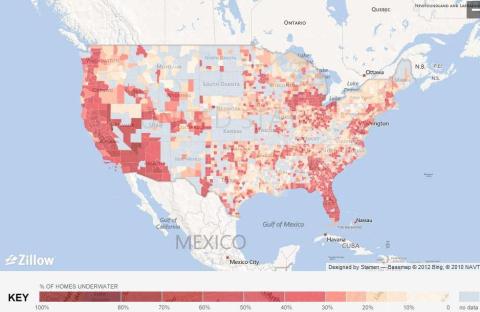

Recently Zillow released a new "Negative Equity" map of the United States, which indicates on a county by county basis what percentage of homes are under-water. By viewing the national map, before "drilling down" to individual counties, one can readily see that the housing market crisis is actually concentrated in specific states, and within those states, there are counties that have astronomical rates of borrowers who are severely under-water, while the next county over may have few, if any home owners who owe more than their home is worth.

Zillow's new Negative Equity Map

Viewing the national map, it's obvious that the areas with the highest concentrations of negative equity are California, Florida, Georgia, Nevada, Arizona and southern Michigan, to name a few "hot spots". While Michigan's problems are more related to long term employment issues, The other crisis states are in the "sunbelt" and had the vast majority of the home building activity during the housing boom years.

Those states with little to no negative equity include South Dakota, Kansas, New Mexico and Idaho. These states saw little of the over-building and "irrational exuberance" of the housing boom.

What we really have here is a tale of two housing markets. But what is more unusual is the fact that these two housing markets exist side by side. For example, in Georgia, now the number 3 state for foreclosure activity in the nation, it's the northwest sector of the state that is primarily impacted by negative equity. Paulding county, Georgia, a western suburb of Atlanta, shows that about 71% of it's homeowners owe more than their homes are currently worth. This is among the worst in the nation. But Macintosh county, on the Georgia coast, shows only 4% of owners with negative equity, among the lowest in the nation, for a state on the "top ten" foreclosure list.

In Clark county, Nevada, the location of Las Vegas, a whopping 71% of home owners are under-water. In southern California, the interior counties such as Kern and San Bernardino are at 60% and 58% respectively. But heading to the coastal counties, LA County is at "only" 38%, and on up the coast, in Marin county, only 19% of homes are in a negative equity position.

The real lesson here is that the housing crisis is very much a local crisis, since some states have no major issues with negative equity, while other states will need years to recover the home values that existed prior to the crash.

It's also interesting to note that many of the counties experiencing major problems with falling prices and negative equity are those located near large metropolitan areas. Buyers who are in the market for a home should use the Zillow Negative Equity Map and/or local data provided by their real estate agent to make sure that they understand the market conditions in the county in which they are shopping for a home.

Negative equity counties can yield some great deals for buyers, but buying "low" in those counties is essential because you can't expect any significant appreciation any time soon.

You may also notice that even in "crisis" states, coastal counties near the ocean have much lower percentages of negative equity than those counties located farther inland, in the interior of the state.

Even in the midst of the largest housing crisis in the history of the United States, there are still many areas enjoying stable or even slightly increasing prices, while many other areas struggle to retain value or continue to lose value. At the end of the day, it all harkens back to the classic real estate mantra...the three most important factors in real estate are "location, location and location".

When it comes to today's housing market, this has never been more true. All real estate buyers are investors, simply because virtually no one ever buys a home with the intention of losing money. Regardless of what the over all market headlines are, the key to successful buying for personal use or investment is to be aware of what is happening with the local housing market in your specific area.

---------------------------------------------------------------------------------------

Donna S. Robinson is a 16 year veteran of the real estate industry. She is a real estate market analyst who specializes in coaching and consulting services for real estate investors. Her website is www.RealtyBizConsulting.com