Ponzi Schemes and other examples of fraud cast a giant shadow on America's recovery and overall future. Just how prevalent property and investment fraud are is not totally clear, but losing billions to criminals cannot help the American Dream.

Ponzi Schemes and other examples of fraud cast a giant shadow on America's recovery and overall future. Just how prevalent property and investment fraud are is not totally clear, but losing billions to criminals cannot help the American Dream.

When things get tough, lawmakers and other leaders simply have to make sure business is on the fair and square. In economic times such as these we are all experiencing, the very last thing we need are schemes and illegal dealings that rob our economy of stimulus. The reports below reveal not only how decision makers are dealing with crooks, but also the widespread and frequent attempts by some to game the system, and rob us all. The following list of recent bad dealings is just what we discovered in a brief Internet search. There are literally hundreds more.

Editor's note: We encourage those of you who may be investors of a type to employ the resources below and the links such as this one to SaveANDInvest.org to help you build on your American Dream, safely. Your country and the world needs your confident entrepreneurship.

Courtesy © intheskies - Fotolia.com

North Carolina Attorney General Roy Cooper is taking a big bite out of real estate investment and other crimes there. According to news from Fayetteville, a budding real estate investment scheme was stopped in its tracks by Wake County Superior Court Judge Paul Gessner. At the crux of this scheme defendants Holly Stevens and the Eddie Peyton Group allegedly told consumers they could profit from buying houses and renting them, when in reality the properties would really be worth far less than the "marks" would have paid for them. In this case the "No Money Down" hook to lure investors could not work because of state officials' diligence.

The Securities and Exchange Commission (SEC) last month charged give former real estate execs with fraud for convincing investors of potential wins from five star resorts in Florida and Las Vegas. The allegations suggest Cay Clubs Resorts and Marinas raised over $300 form 1400 plus investors touting the potential for a "guaranteed" 15 percent ROI. Instead of using the collected funds to develop the highly publicized resorts Cay Clubs execs instead posted returns to earlier investors. In this familiar Ponzi scenario perpetrators buy up luxury items and live "the lifestyle" while the end result for those investing is always the same. Loss. Eric I.

Bustillo, Director of the SEC’s Miami Regional Office, offered this via Real Estate Rama:

“These Cay Clubs executives lined their pockets with millions of dollars that they told investors would be used to develop five-star resort properties. They continued to defraud investors as Cay Clubs collapsed.”

The SEC’s complaint is filed against the following executives: Fred Davis Clark, Jr. – president and CEO, David W. Schwarz – chief accounting officer, Cristal R. Coleman – manager and sales agent, Barry J. Graham – sales director, and Ricky Lynn Stokes – sales director. Readers should follow the news link to the original story.

The Arizona Corporation Commission has ordered a dozen real estate related firms to pay over $4 million in restitution for cases of fraud and administrative penalties in connection with securities and other violations. One such ACC case involved defendants of defrauding investors with a promissory note scheme for a total of $3 million. In another, two Tuscon men's intended investment scheme was derailed when a Phoenix stockbroker's registration was revoked even before any harm to potential investors could be leveled.

The Phoenix Business Journal reported on the detailed charges, but indicative of the many was Huel Cox's nearly $100,000 censure for convincing investors to put their annuities and other savings into, among other investments, a casino in Florida. Instead of investing the money for the people, Cox instead put the funds in his personal account and allegedly paid rent and other bills with same.

Before reading on, you may want to watch the video below from KCTS9 concerning how to outsmart those who intend to perpetrate investment fraud.

A Connecticut man was convicted of fraud in Maine recently for a real estate wire fraud in which he garnered $600,000 in investment from a retiree to do no less than pay the down payment on land in Hungary. Federal prosecutors contend Peter DiRosa (65) transferred a large portion of the money to his private account, on top of having lied about the potential of the investment, and about the people associated with the deal. DiRosa faces up to 20 years in prison and a fine of a quarter of a million dollars, plus paying back all the money at sentencing.

According to the Journal Inquirer story, DiRosa was actually the former Mayor of Manchester, Maine.

When David Connolly defaulted on some of the mortgages tied to his Ponzi Scheme, the SEC was alerted to a massive plot to defraud some 200 investors of $50 million dollars. Admitting his scheme, Connolly pleaded guilty the other day to securities fraud and money laundering. He now faces up to 30 years in prison. The 51 year old Connolly assured his "marks" they would get a massive rental income via monthly distributions. Those distributions only turned out to be the more recent investments of current investors though. Connolly, as is typical, used a large portion of the invested money for his own purposes. Investigations by the IRS, FBI, and the SEC led to the eventual collapse of the fraud.

A complex web dealings by developer Gregory D. Jeffreys and his girlfriend may end up being a Ponzi Scheme of some magnitude if prosecutors there are right in the accusations. According to Federal authorities Jeffreys and his accomplice convinced investors there was gain in a maze of limited liability companies that Jeffreys supposedly set up to perpetrate the fraud. According to the charges investors came from as far afield as Texas, Louisiana, California, Kansas, Wisconsin, Florida, New York and Oregon. Apparently the prosecutors have evidence to prove Jeffreys had investors put up money for properties that do not even exist, and so forth. There also seems to be evidence collected funds were used for Jeffreys' own personal use too.

Courtesy Stanford Center on Longevity

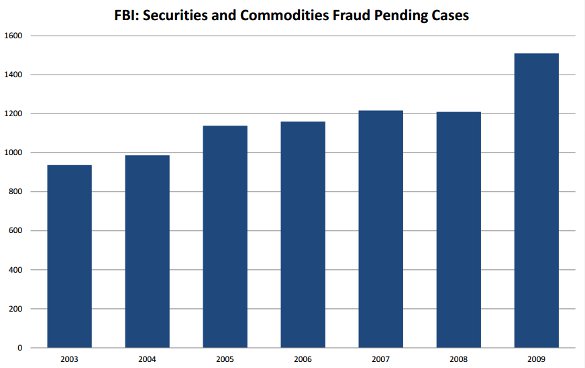

If we were to search public records and news accounts for every state, there is no doubt investors and taxpayers in each and every one would have been severely burdened by the financial weight of these schemes. And those would say little for the investor confidence which might propel a faster recovery. Jobs, families, little kids, and the future of a nation rest substantially on the ability of government and all decision makers to prevent and punish these crimes. In the end, a Ponzi Scheme and lavish criminal lifestyles in New York, condemn the construction worker in Florida to more months out of work. The chart above shows the trend analysis of fraud in America, things are getting worse, rather than better - and at exactly the WRONG time.

This is the right picture of America - courtesy SaveAndInvest.org Facebook

To learn more about the multi-billion dollar cost of fraud in America, please visit Fight Fraud in America or the Financial Fraud Research Center. Realty Biz News commends officials and lawmakers for their vigilance. All too often we are quick to judge based on the things we find wrong with our system. It may be high time we looked at what is right, and support that. Let us know your thoughts.

Additional image credit: Charles Ponzi - courtesy the US Government and Wikipedia