The homeownership rate in America continues to hover around a 50-year low, but experts gathered for an event in the Washington, D.C. offices of the National Association of Realtors last week said that there are real-world opportunities to turn that trend around.

“It’s tough out there right now for buyers, especially in many of the red-hot markets around the country where competition is the fiercest,” said National Association of Realtors President William E. Brown, a Realtor from Alamo, California and founder of Investment Properties. “Thankfully, we know there are ways to help consumers. Addressing the growing student loan burden, widening the credit box for strong buyers, building more homes that meet the demand of lower and middle-income buyers – these are among the many steps we can take to clear the pathway to homeownership.”

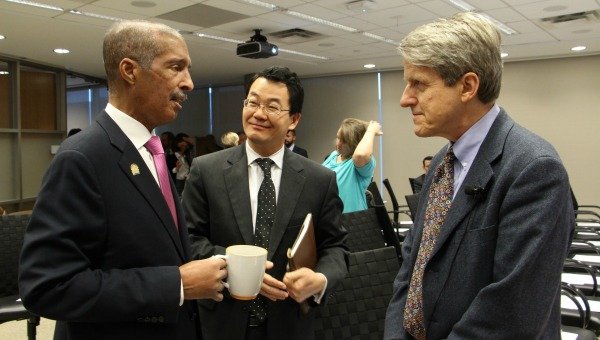

The event on housing and homeownership was headlined by Nobel Prize Winning economist Dr. Robert Shiller, who offered his take on the housing market’s history and possible future. He looked at trends in oil prices, building costs, and other factors that play a role in driving demand, but told the packed audience that public sentiment clearly plays its own role in driving the housing market.

Looking at the recovery since the Great Recession, Shiller said “it’s kind of obvious that home prices have been rising at a good clip… But it’s not because of building costs, population trends, or interests rates.” Instead, Shiller said “it’s the changing narrative and the stories that go along with it.”

To make his point, Dr. Shiller showed data on the expected average annual increase of recent homebuyers, from 2002 to 2016. He noted that in the run-up to the Great Recession, homebuyers expected an average annual increase in home values as high as 13 percent. Since then that expectation has fallen, changing the narrative of the housing market.

“That’s why I don’t think we’re in a bubble now,” Shiller said. “It’s not as it was in 2004.”

Following Dr. Shiller’s remarks, CNBC real estate correspondent Diana Olick moderated a panel of experts including NAR’s Chief Economist Lawrence Yun; Dr. Beth Ann Bovino, chief U.S. economist at S&P Global; Dr. Susan Wachter, Albert Sussman Professor of Real Estate, Wharton School of Business; and Dr. John Weicher, Director, Center for Housing and Financial Markets, Hudson Institute.

The noted economists honed in on the homeownership rate and its importance to the broader economy. Yun in particular talked about challenges to homeownership including rising rents and student debt loads, noting that the difficulty in purchasing a home has led to a growing wealth inequality between generations.

“There is a tremendous wealth buildup among people who are 65 and older,” Yun said. “They have essentially paid off their mortgages.” For the younger generation, including those under 35 years of age, Yun said “they feel that they are being left out.” Yun added that while the pendulum swung too far towards loose underwriting before the Great Recession, it has since swung in the other direction, leading to what he described as “overly strict underwriting standards” that can put homeownership out of reach for even strong buyers in some circumstances.