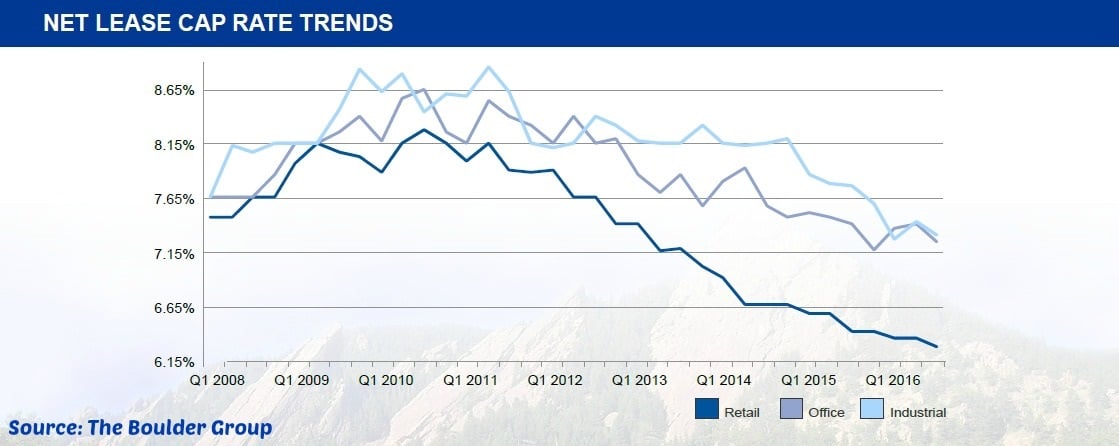

Cap rates in the third quarter of 2016 for the single tenant net lease retail sector reached a new historic low rate of 6.10%. During the same period, cap rates for the office and industrial sectors decreased to 7.08% and 7.14% respectively. The overall net lease market remains active with 1031 and private investors due to the passive nature of the leases and attractiveness of relative investment returns when compared to other asset classes.

The uncertainty of traditional investment asset classes coupled with the stable yields generated by the single tenant sector has created an abundance of investor demand for this sector. Despite a slight rise in the supply of net lease properties, there is a lack of new construction properties with long term leases. Accordingly, during the third quarter cap rates for recently constructed properties tenanted by McDonalds, DaVita and Advance Auto Parts compressed by 30, 25 and 15 basis points, respectively. This accounted for the greatest retail tenant compression as noted in the cap rates by year built chart.

While newly constructed assets for certain tenants remain in high demand and limited supply, the dollar store tenants continue to expand and add an abundant supply of new construction to the market. The dollar store sector remains to be one of the sectors with increasing cap rates despite the current low cap rate environment due to their large supply on the market. However, these assets remain in demand with investors who have 1031 exchanges with small equity requirements due to their low price points and long term leases with creditworthy tenants.

The net lease market should remain active throughout the remainder of the year, with the expectation that cap rates should hold steady for the near term. The market will remain favorable to sellers as investors continue to seek this asset class due to the passive nature of the leases and institutional and fund investors attempt to reach fund allocations by years end.

About the author: Randy Blankstein is President of net lease advisory firm The Boulder Group.