With housing becoming more and more unaffordable in the U.S., a new Zillow analysis shows that residents in the capital, Washington D.C. have the most cash left over after paying their mortgage.

Zillow’s study assumes the median annual gross income and mortgage payment for each of the 35 largest housing markets in the U.S. Its data shows that residents in the capital have almost $7,000 of their monthly incomes left to spare after paying for their home. That compares to second place San Jose, whose residents have on average, $6,800 after paying their mortgage repayments.

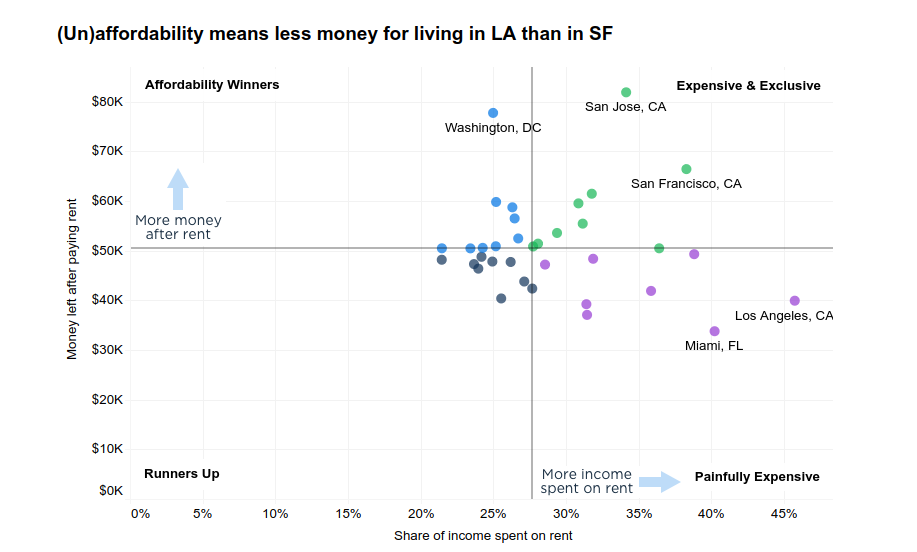

At the opposite end of the scale, residents of Los Angeles and Florida struggle the most. In LA, homeowners there average $3,450 per month left over, which is slightly less than those living in Miami, Tampa Bay and Orlando. However, renters in those three Florida cities have the smallest amount of leftover cash after paying their monthly rent.

Unfortunately for LA residents, they’re left with even less when the substantial income tax rates of California are taken into consideration. Those taxes cut deep into whatever income is left over for other expenses, such as food, transportation, child care and education costs.

"In our quest for happiness, or at least satisfaction, we must accept tradeoffs,” said Skylar Olsen, Zillow’s Director of Economic Research. “A good-paying job with career growth potential often comes with expensive housing, leaving less for life's other essentials such as taxes, child care, transportation, medical services, food and leisure. Finding that balance where housing costs leave a comfortable amount of spending money is tricky, especially when the prices of life's non-housing essentials also vary widely by market."

The bad news for buyers is that affordability overall has worsened in the last year due to rising interest rates and accelerating home value appreciation over the last year. In November, the average 30-year fixed rate mortgage had risen to 4.94 percent, up from 3.95 percent at the start of the year. Fortunately, rates have now dipped slightly to below 4.4 percent, while home value appreciation is finally beginning to cool in many markets. That could lead to better affordability in recent months, Zillow said.

Other data from Zillow’s study shows that a mortgage payment on the typical home in the U.S. required 17.5 percent of the median income in Q4 2018. This is up from 15.4 percent in the last quarter of 2017 but still below the historic average of 21 percent from the late 1980s and 1990s. Using this traditional measure of housing affordability, less expensive Midwest markets such as Pittsburgh, St. Louis and Cincinnati top the list.

The typical U.S. renter spent 27.7 percent of their income on rent payments in 2018. This is down slightly from 28.1 percent in 2017, but higher than the historic average of 25.8 percent. Rent payments accounted for more than 30 percent of the median income in 13 large U.S. metros, widely considered the standard for unaffordable housing costs.