Nationally, U.S. homeowners spend $15,190 on average in extra or hidden costs associated with selling their home, according to a new analysis from Zillow and Thumbtack, an online service that matches customers with local professionals. Since most (63 percent) of today's sellers have never sold a home before, some of these costs could come as a surprise.

To help with budgeting, Zillow and Thumbtack calculated several common, but often overlooked, seller expenses including sales taxes and agent commissions, as well as five optional home prep projects.

More than eight out of 10 home sellers make improvements before listing. While some sellers prefer to complete these projects themselves, those who outsource can expect to spend more than $2,650 nationally to cover staging, carpet cleaning, interior painting, lawn care and house cleaning – five of the most popular seller home prep projects. Labor costs vary significantly by region, so sellers in Los Angeles pay an average of $4,000 for the same projects, compared to sellers in Columbus, Ohio, who pay $1,500.

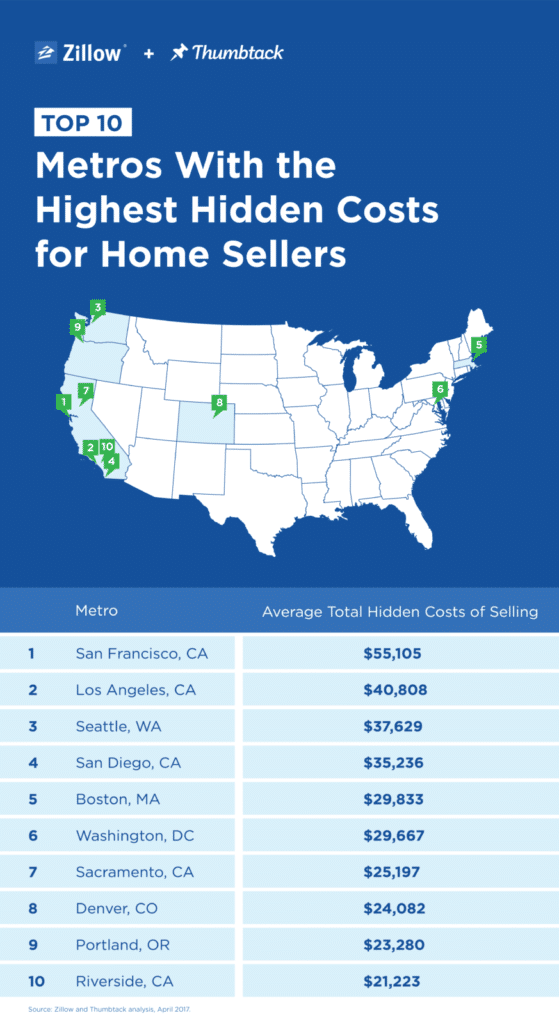

The two largest closing costs are agent commissions and in most states, sales or transfer taxes. Nationally, sellers spend $12,532 for both closing costs on the median home. Since they are percentages of the home's sale price, sellers in hot coastal markets like San Francisco pay $51,520 on the median home, the highest of the metros analyzed. Sellers in Indianapolis pay the least ($8,238) as home values are lower and the state has no transfer tax.

From title insurance to escrow fees, sellers are responsible for a variety of other smaller closing costs. Even though selling a home costs money, most (73 percent) sellers are still satisfied with the transaction. To estimate potential profit, sellers can use Zillow's Sale Proceeds Calculator. It factors in the home's sale price, mortgage balance and agent commissions, along with other common seller fees.

"One of the biggest regrets sellers have is not starting the process early enough," says Jeremy Wacksman, Zillow Group chief marketing officer. "For those planning to sell this year, take your time to research all the costs you could be responsible for and how they may affect your profit, or even budget for your next home. Partner with a great agent who can help you understand the nuances in your market – from what taxes or closing costs you should expect, to which home renovation projects can help attract the right buyer."

"Sellers need to consider these additional, often necessary costs when planning to put their home on the market," says Lucas Puente, Thumbtack economist. "While it's clear these costs vary widely, often times the easiest way to ensure a home is fully prepared to be sold is to hire local, skilled professionals to help with basic home projects."