For the seventh consecutive month, the gap has widened between what home owners say their home is worth compared to what appraisers say, according to Quicken Loans’ August 2015 Home Price Perception Index.

Quicken Loans’ Home Value Index (HVI), a measure of home value changes based on actual appraisals, reported national housing values were nearly flat in August from the month prior, with the slight drop of 0.05 percent. This is less than the 0.27 percent decrease in July. Home values continued to rise annually, showing a 3.24 percent increase in value nationally compared to August 2014.

However, the average difference between homeowner estimates and appraised values continues to increase, according to the national HPPI. Homeowner’s estimates now stand 2.65 percent higher than appraiser opinions, the largest gap in more than a year, according to the index.

“The perception trend of most of this year suggests home owners may be assuming that home values have been in a steady, linear path upward,” says Bob Walters, Quicken Loans chief economist. “In reality, home values have remained mostly flat this year, and this false assumption may be leaving home owners disappointed when their appraisals come in.”

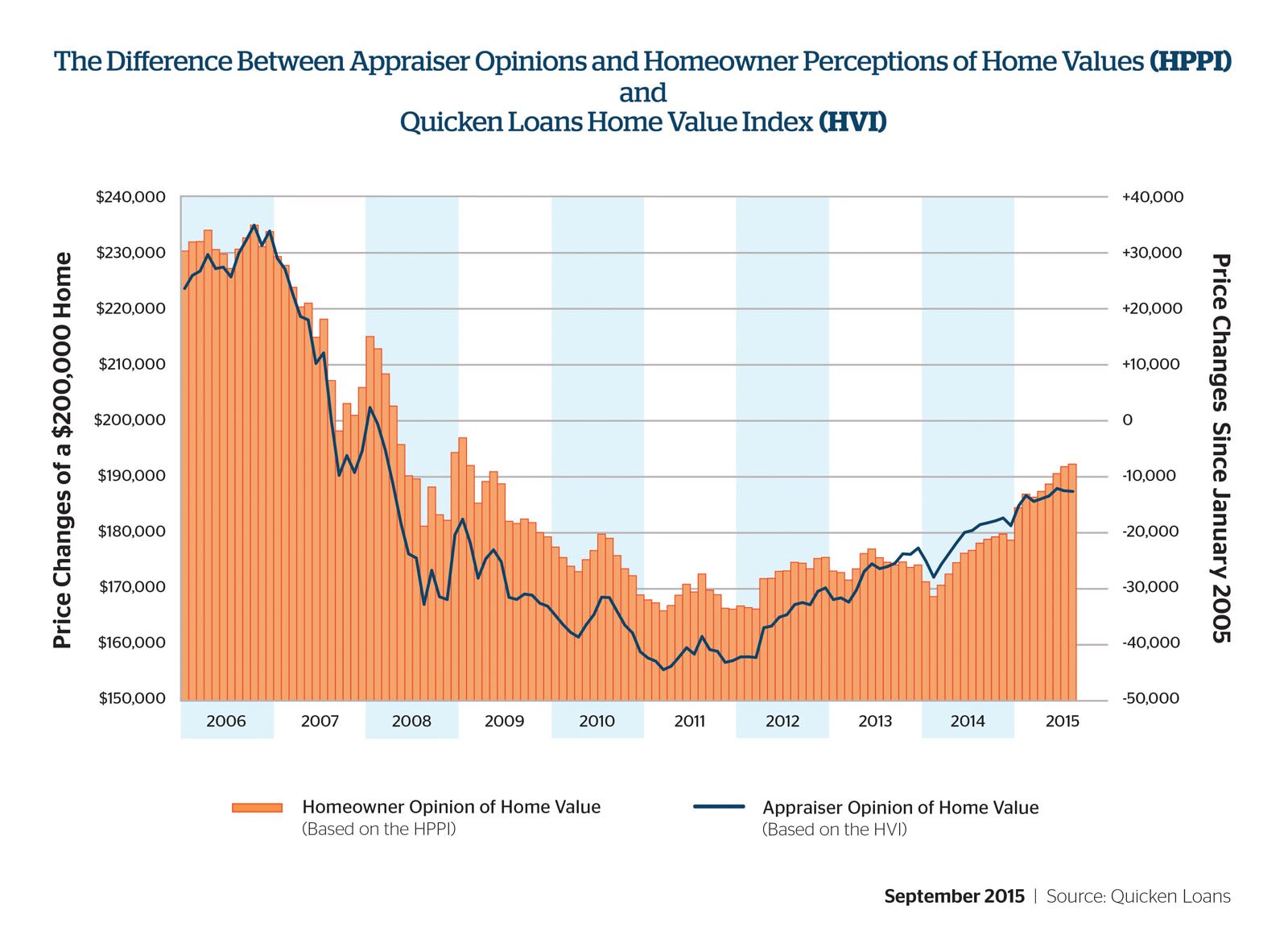

The following graphic gauges homeowners’ versus appraisers’ value perceptions over the last ten years.

The Quicken Loans HPPI represents the difference between appraisers’ and homeowners’ opinions of home values. The index compares the estimate that the homeowner supplies on a refinance mortgage application to the appraisal that is performed later in the mortgage process.

This is an unprecedented report that gives a never-before-seen analysis of how homeowners are viewing the housing market. The HPPI national composite is determined by analyzing appraisal and homeowner estimates throughout the entire country, including data points from both inside and outside the metro areas specifically called out in the above report.