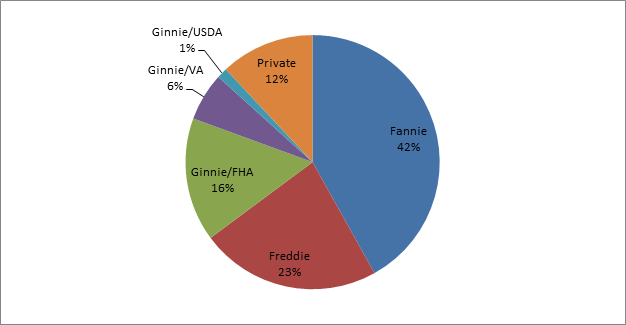

According to the May 2012 Issue of FHA Watch, Uncle Sam is now a totally dominant force in home mortgage financing, along with other major sectors of the U.S. economy. But the question is, is this a help or a hindrance?

RealtyBizNews: Real Estate News & More

With the latest on mortgages, refinancing, real estate & home tips

The National Mortgage Settlement has been finalized and the $2.5 billion dollar bank payout is being allocated among the 49 participating states. But among those states that were hardest hit by the foreclosure crisis, only Georgia has no plans to allocate any of their $99 million dollar share of the settlement to help homeowners who are struggling to avoid foreclosure.

Realty Trac released their latest report on foreclosure activity. They use the term “mixed” to describe the results. While that is generally true, the real story is found in the states where the cities in the report are located. Those cities showing increases in foreclosure activity are located in “Judicial Foreclosure” states

The jobs report released on April 6th, posted much lower than expected numbers. After February numbers had managed to reach the 200,000 mark, it was assumed (there’s that word again), that the March report would indicate a job market that was beginning to show signs of life. But instead, the report was a disappointing 120,000 new jobs.

It’s a “Twilight Zone” kind of plot twist that even Rod Sterling could not have imagined. Wall Street’s biggest names are rushing to jump into the single family rental market in a big way. They believe that there are “fat profits” to be made in the rental property business, and many of the same firms [...]

Previously, I pointed out that the uptick in home sales in many areas is being driven by all cash buyers, many of whom are real estate investors. Well, actually let me say right here that anyone smart enough to be buying in the current market at today’s prices IS a real estate investor, and a darn good one at that.