A mortgage forbearance is not a good thing. For many people facing this dilemma, it can be the first step before foreclosure begins. Probably the most important two things you want to do as you face this prospect are 1) educate yourself about your options and 2) think long term. A mortgage forbearance is NOT […]

Study: Down payment assistance doesn’t mean a higher chance of defaulting

Common wisdom has it that home buyers who rely on down payment assistance are more likely to default on their mortgage repayments, but a new study has debunked that theory. The study, by the Center for Household Financial Stability at the Federal Reserve Bank of St. Louis, found that buyers who receive financial assistance with […]

Fannie and Freddie introduce new standard mortgage application form

Fannie Mae and Freddie Mac say their redesigned mortgage application form came into effect last week. The new form removes certain questions over applicant’s language preferences and housing counseling information. The Uniform Residential Loan Application is a standardized form that needs to be completed by most borrowers when they apply for a mortgage. Last weeks’ […]

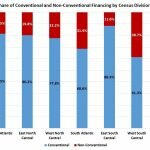

Unconventional loans grow in popularity

With home prices on the rise, a growing number of buyers are turning to unconventional types of loans to finance their purchases, especially in some western southern markets. Unconventional financing now accounts for around 28% of the new home build market, according to a new analysis of U.S. Census Bureau data by the National Association […]

Alternative mortgages providing a back door to homeownership

Consumers with bad credit ratings are increasingly taking advantage of alternative mortgage products that allow them to buy a home without a huge down payment, often through lease-to-own contracts. But borrowers still need a steady income to qualify for these products, the Wall Street Journal reported. One example is a company called Divvy Homes, which […]

Digital mortgage applications result in less discrimination, study finds

Digital mortgage applications are having the positive effect of reducing discrimination of black and Latino home buyers, a new study shows. The study, by the National Bureau of Economic Research, reveals that algorithmic lending reduces discrimination by up to 40% compared to applications which are dealt with face-to-face. With digital mortgage applications, the interest rates […]

Fannie & Freddie allowed to retain their profits

The government says Fannie Mae and Freddie Mac will be allowed to retain $45 billion worth of their earnings this year, as part of a plan to help the government-sponsored entities return to private ownership. The vast majority of Fannie’s and Freddie’s profits have gone to the U.S. Treasury Department ever since they went into […]

Here’s why you really need to shop around for a mortgage

The typical home buyer spends more than four months shopping for the perfect place. They tour an average of more than four homes, attend two open houses and make two offers. That’s not to mention the hours spent browsing online listings. But most buyers still don’t shop around for the best mortgage rate. And buyers […]

What a 0% mortgage rate would mean for housing

U.S. President Donald Trump last week called on the Federal Reserve to drop its key interest rate to zero, or even negative, when it convenes its next meeting later this month. The call has sparked discussion among real estate experts on how zero interest rates would impact the housing market. The obvious impact is that […]

White House proposes to end conservatorship of Fannie and Freddie

U.S. President Donald Trump’s administration last week put forward several proposals aimed at modernizing the Federal Housing Finance Agency and ending the federal government’s decade-long conservatorship of the government-sponsored enterprises. The proposals came following a demand from President Trump that responsible agencies come up with some meaningful reforms to the system, in order to reduce […]