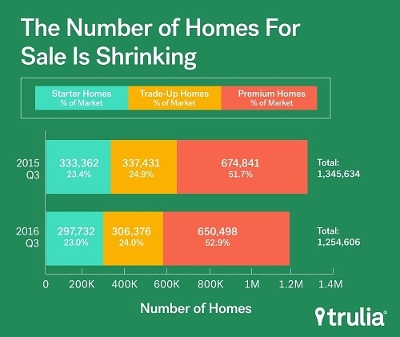

A new report from Trulia shows housing inventories fell for the fifth straight quarter, pushing home affordability further out of reach for more Americans.

Meanwhile, in some markets across the country, inventory show signs of picking up. Nationally, housing inventory continues to dive. This summer, the number of homes on the market dropped for the fifth straight quarter, extending a slump and dropping 6.7% over the past year. The number of starter and trade-up homes on the market nationwide has dropped by 10.7% and 9.2%, respectively.

In addition, premium home inventory dropped just 3.2% over the past year. The persistent and disproportional drop in starter and tradeup home inventory is pushing affordability further out of reach for homebuyers. Starter and trade-up homebuyers need to spend 1.7% and 0.9% more of their income than this time last year, whereas premium homebuyers only need to shell out 0.6% more of their income.

Starter Homebuyers Face the Biggest Impacts of Declining Affordability

Falling inventory continues to take a toll on affordability. Starter homebuyers need to dedicate 38.5% of their monthly income to buy a starter home – a 1.7 point increase from last year. While not a hard ceiling, applying for a mortgage with a debt-to-income ratio of more than the 36% guideline used by lenders such as Fannie Mae will make the mortgage approval process more complicated for first-time buyers, especially when factoring in other debt like student loans, credit cards, and auto payments. Most trade-up and premium home buyers, on the other hand, are still in the clear. Each would need to spend just 25.5% and 13.9% of their income to buy a home, respectively.

Signs of Increased Inventory Appear on the West Coast and Florida

Although low inventory has been a persistent national trend over the past few years, relief is on the way for homebuyers in some markets. Of the 100 largest markets, 21 have experienced increases in inventory over the past year, with many showing double-digit gains. However, half of these markets are in just two states: California and Florida. When looking at markets that have shown rising inventory for at least three consecutive quarters, four markets have hit an upward streak: Bakersfield, Calif., San Francisco, Sarasota, Fla., and West Palm Beach, Fla.

“Nothing is permanent, not even low inventory,” said Trulia Chief Economist Ralph McLaughlin. “With notoriously stingy markets like San Francisco, San Jose and Denver showing signs of picking up after prolonged periods of declining inventory, homebuyers in these markets are beginning to see a break in gridlock and should experience more choice in the months ahead.”