Net lease cap rates are expected to rise across the board in 2017, according to a new poll by The Boulder Group. Cap rates in the fourth quarter of 2016 for the single tenant net lease sector increased or remained the same for all three asset classes. Retail cap rates experienced their first increase since the third quarter of 2013 to 6.19% cap rate.

The 9 basis point increase is the largest increase in retail cap rates since the second quarter of 2011. Cap rates for the office sector remained unchanged at 7.08% while the industrial sector increased by 3 basis points to 7.17%.

The main contributing factor for the increase in cap rates for the retail sector can be attributed to the rise of treasury rates during the fourth quarter. During the fourth quarter, the 10 Year Treasury Yield increased significantly to 2.45; up from 1.62 at the start of the quarter. Net lease participants were careful to monitor the effect of the rising treasury rates for net lease valuations.

During the fourth quarter, the spread between asking and closed cap rates for retail properties increased by 5 basis points. This was the largest spread between asking and closed cap rates for retail properties since the fourth quarter of 2013. The spread between asking and closed cap rates for all three sectors (retail, office and industrial) ranged between 31 and 32 basis points.

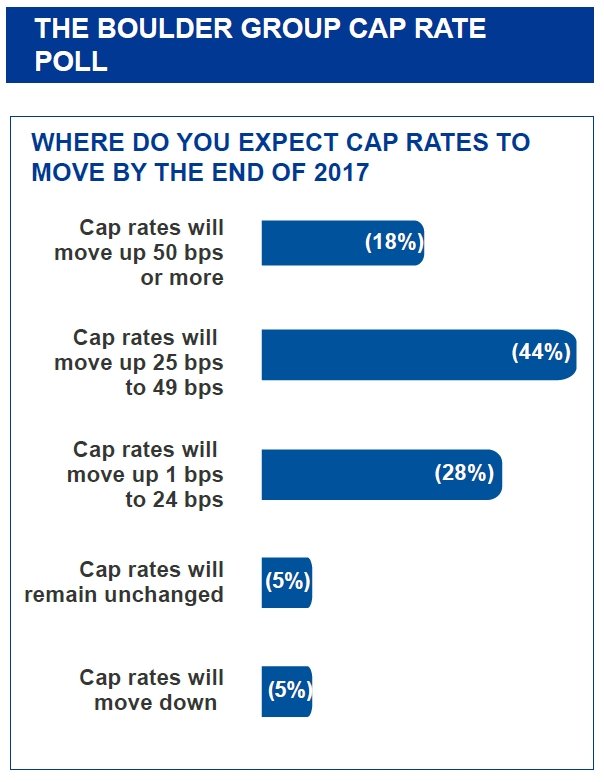

The net lease market is expected to remain active in 2017 as investor demand for this asset class remains. The expectation is that there will likely be upward movement in cap rates moving forward. In a recent national survey conducted by The Boulder Group, the vast majority of active net lease participants expect cap rates to rise in 2017. The largest segment of net lease participants expect cap rates to increase between 25 and 49 basis points by the end of 2017. After the decision to increase rates at the December Federal Reserve meeting, investors will carefully monitor the capital markets and effect on pricing.

About the author: Randy Blankstein is President of net lease advisory firm The Boulder Group. http://bouldergroup.com/