It was reported by Competitive Home Lending that an astonishing 85% of homebuyers in Texas are overpaying for their mortgage rates. This figure is based on the average home price in the Dallas area, with buyers potentially facing up to an additional $30,000 in interest payments throughout their loan when opting for retail mortgage rates.

Texas's top ten mortgage lenders collectively hold over 47% of the market share. Apart from offering exceptional customer service and a wide range of mortgage loan programs, these prominent companies also provide lower wholesale mortgage rates through authorised mortgage brokers like Competitive Home Lending.

Despite the potential for significant cost savings these mortgage lenders offer through local mortgage broker channels, fewer than 30% of borrowers are currently taking advantage of these savings.

"It is our responsibility to extend the opportunity to make home ownership more affordable to families buying homes in Texas," says mortgage broker Raul Hernandez.

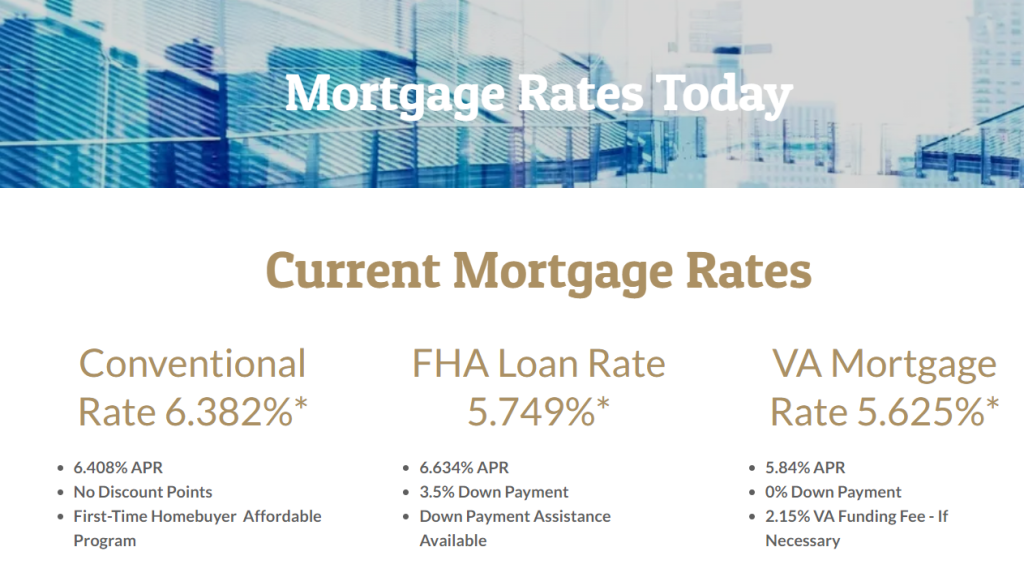

Current mortgage interest rates are consistently displayed to facilitate easy comparison of mortgage rates and to incentivise prospective buyers to seek out the most favourable lender.

"We offer the exact same home loans directly from the nation's best lenders but at a lower mortgage rate that is not padded with the added cost of loan officer commission," added Hernandez.

Direct collaboration with a mortgage broker eradicates the need to cover a loan officer's commission, ultimately reducing the overall cost of homeownership. Nonetheless, the challenge for homebuyers lies in locating a mortgage broker within a market inundated with loan officers. The NMLS consumer access directory is an excellent resource for validating whether the loan officer managing your home loan is indeed the broker for the company.

Real estate agents seeking to augment the quality of service provided to their buyers have forged partnerships with Competitive Home Lending. The number of real estate agents familiarising themselves with the advantages of securing a lower mortgage rate for their clients is steadily increasing.

Competitive Home Lending's network of real estate agents is aware that reduced mortgage rates tend to allure more buyers owing to the consequent decrease in mortgage payments. As a result, agents have successfully presented higher-priced homes to their clients, courtesy of our favourable rates, thereby gaining a competitive edge in the market.

Click here to see if you qualify for a home loan.

Competitive Home Lending, a Texas mortgage broker specialising in wholesale mortgage loans, is registered under Mortgage Company NMLS 1047944, MLO NMLS 216096.