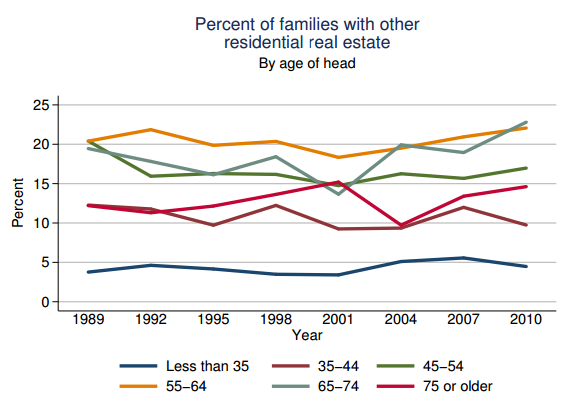

A recent article on doctorhousingboom.com clearly demonstrates the impact that boomers are having on the housing market. Boomers between the ages of 55 and 74 are much more likely to own additional residential property besides their personal home, and while some of these homes are vacation properties, most are likely to be held for use as rental property.

© Monkey Business - Fotolia.com

It's interesting that the two primary age groups for owning multiple properties are those above the age of 55. Those most likely to own more than one residential property are more motivated to prepare for retirement, looking to build a passive income, and prepare for a time when they will no longer have to work. Or perhaps a time when they won't be able to.

One of the primary benefits of real estate investing is the ability to create multiple streams of income which can be secured by a type of collateral that falls into a critical group of basic human needs. This fact makes residential real estate an enduring investment that will always be in demand. And I discovered 12 years ago, when my husband suddenly fell critically ill, passive income is mighty handy when the unthinkable emergency happens and suddenly your spouse is bedridden, leaving you to figure out how to work and be a 24 hour-a-day caregiver.

Seniors today are facing a unique set of economic challenges. Today's baby-boomer seniors have dealt with inflation for their entire adult lives. In fact, I am a "boomer" who was born in 1956. Like all baby boomers, I've experienced the effects of inflation eating away at my earning power for my entire lifetime. Since 1956 Inflation is a cumulative 750.4%

Every $100 earned the year I was born, today requires $850.43 to get the same buying power. In short, to keep up with inflation, you have to have see your income increase every year, year in and year out. But as all boomers know, growing your income fast enough to keep pace with unrelenting inflation is more easily said than done. The likelihood of your income going up steadily year after year is almost impossible without having other investments like real estate.

And yes, that being said, you DO have to have some education and sense about when to invest and how much to pay. Boomers also helped drive the housing crisis, and many boomers are now paying the price for their financial indiscretions.

Image credit:doctorhousingbubble.com

With the current monetary policies being implemented in the U.S. by Ben Bernanke and company, inflation could get much worse in the near future. Indeed, in my weekly role as a grocery shopper, I'd have to say that some prices are up as much as 100% over just the past two years. My grocery bill has gone up about 20 to 30% since 2010, along with gasoline prices, which have risen dramatically. With such rampant, widespread inflation, with more to come in the future, real estate represents one of the few investments that can help aging boomers deal with the challenges of falling incomes and high unemployment.

While the official unemployment rate may be 8.9%, among boomers, unemployment has grown by 6-fold since the recession began in 2007. The employment problems are very systemic for boomers who grew up in an era that did not have personal computers, cell phones, or even hand held calculators. But that being said, and in spite of our financial challenges, the fact always remains that real estate offers income opportunities and options for boomers that simply no longer exist in the corporate arena. And those opportunities, while made easier if you have cash and credit, do not require cash or good credit in order to get started.

As a result, boomers tend to be much more interested in real estate investing than their younger counterparts. There are real estate investor associations, also referred to as "REIA's" in every major U.S. city. Some cities have two or three different clubs. Many of those clubs also have sub-groups in various local areas that allow for smaller groups of like-minded investors to meet and network. Lately these clubs have been struggling since the housing downturn, but make no mistake creative real estate investing is alive and well for aging boomers who know that social security benefits are likely to go down in the future. And, when converted into 1956 dollars, today's average social security benefit of about $900 per month is only equivalent to $105.83!

Boomers who are not invested in an income producing vehicle such as real estate are facing a future in which they will have to live on less money than their grandparents. Boomers who are smart know that they can't and won't let this happen.

When it's all said and done, boomers have a major challenge on their hands keeping up with inflation and insuring that they have an adequate retirement income. And many of them know that residential real estate ownership for investment is still one of the primary ways in which they can reach the goal of a secure retirement.

-------------------------------------------------------------------------------------------------------------------------------

Donna S. Robinson is a real estate investor, author and residential market analyst located in Atlanta, GA. Follow her on twitter at donnaconsults. Her latest book, Basics Of Real Estate Investing is now available on Amazon.