Are you thinking about moving?

If so, you have probably given considerable thought as to whether it's better to buy or rent. And for many, that's a tough decision. There are so many questions and so many different issues that factor into making such a decision.

So how do you go about deciding whether to buy or rent?

Well, the best way to go about weighing the decision about whether to buy vs rent is to compare the pros and cons of each and to ask yourself a wide variety of questions that will lead you to your answer.

OK, I know what you're thinking...

You've read other articles on this issue and keep getting the same old rehashed answers. So that doesn't really work now, does it?

No—not usually.

But...

This article is going to be different because we have in-depth knowledge with inside information from a licensed realtor, as well as a seasoned property management expert with years of experience dealing with rentals. So by the end of this article, you will have all the information you need to make a decision about the buy vs rent debate that's taking place in your mind.

Let's get started!

Before you do anything else, you should assess your financial situation by asking yourself the following questions.

How much can I afford to pay each month for housing?

How much do I have in savings?

How long do I anticipate living in this particular home?

Do I need long-term stability or the flexibility to move around?

Do I have the time and money required to perform my own repairs, maintenance, and any major replacements that come up?

What are my family's needs now and going forward? Do I need a big backyard for pets, a pool, a kid's playhouse, trampoline, etc.? And, how many bedrooms/bathrooms am I going to need now and in the future?

Will my family be growing or downsizing? Do I have a growing family or kids that are coming of age and will be moving out?

How big of a home will I need? Do I need space for a growing family or do I have the need to make room for an aging loved one? Or, do I need something smaller because I am now an empty-nester?

These are just a few of the questions you will need answers to before you begin your quest of finding a new home.

Next, let's talk about the pros and cons of buying a home versus renting a home in 2019.

It's hard to believe that anyone can afford to live anywhere these days with the cost of homes increasing and the monthly rental rates rising even faster. That's why it's more important than ever to make the right decision when it comes to buying versus renting in 2019 and beyond.

PROS:

CONS:

PROS:

CONS:

OK, now let's get down to the nitty-gritty about whether it's better to buy a home or rent a home based on the most common questions the experts answer every day. Then we'll give you a few scenarios to consider that will help you finalize your decision about the buy vs rent debate. This is going to be eye-opening so you don't want to miss it! There are definitely scenarios you probably have never thought could even be an issue in the first place—WRONG!

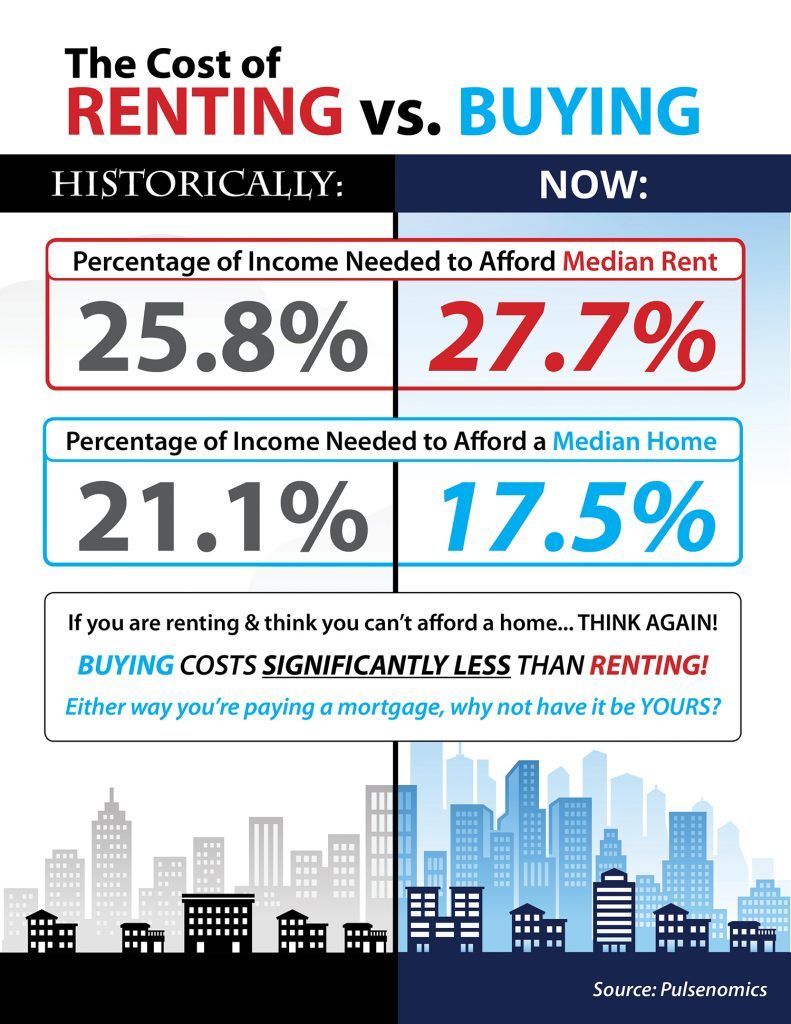

The answer to this question is twofold. Yes, buying a house versus renting a house is always your best bet because you are not throwing money away on something that's not yours. So, in this respect, yes, it is affordable to buy a home regardless of the price homes are selling for at any given moment.

The second half of the answer is also yes, because if you think about it—how often do rental rates go up? They go up every six months to a year; whereas, most mortgages will stay the same (except for the possible property tax and/or insurance rate increases).

Another thing to keep in mind, if you currently own a home, is that regardless of whether the home prices are rising or falling, your house will be doing the same. For example, at the time you decide to sell, unless you are moving to a different location, your home will sell for the going market rate. However, the home you buy will also be selling for the going market rate, which means you really can't lose because the transactions are apples to apples transactions.

Now, in this scenario, you won't necessarily be trading up so to speak, because you might not have much, or any, equity in your home, but you can always sell, and buy, apples to apples and not lose, if you are doing so in the same general area. So don't worry too much about what the housing market is doing and do what's best for you and your family.

Yes, yes, and YES! Why would you want to dig deeper into your budget every six months to a year to line someone else's pockets and have nothing to show for it? Exactly! That won't get you anywhere.

If for no other reason, buying a home is a great investment because you are paying for something you will eventually own. Or, something that will give you most, if not all, of your money back (maybe more).

Yea, you might not have to do any maintenance, but is all that maintenance really worth that $1000-$1500 per month you are paying in rent? Well, let's see, at the very least, $1000/mo. in rent equals $12,000/yr. Just imagine what you could do with $12,000/yr.? Or, what $12,000/yr. in home equity would do for you?

You just moved into your new apartment and can't wait to hang those curtains you bought that match your home's theme and decor.

But wait...

Nope! You can't do that because the landlord has strict rules about what can be seen from the exterior and demands a consistent look.

You just moved into your new rental house/apartment and suddenly don't feel all that safe, so you decide to have a top-of-the-line security system installed.

Yep, you guessed it.

You can't do that either because it poses a liability to your landlord so you have to settle for a basic security system that doesn't have all the features you want.

You just moved into your new rental house/apartment and brought with you the yard decor you had at your old place. But again, there's a problem. Your landlord and/or the neighborhood homeowner's association has just informed you that your taste in decor doesn't fit the community; therefore, it has to be removed.

Not cool!

You recently moved into a new rental house/apartment and decided to get a pet to keep you company, or one your kids have been begging you for.

But wait...

One of your neighbors saw you bringing that pet onto the property and reported you to management.

No big deal right?

WRONG!

The management has rules against the type of pet you got and is demanding you remove that pet or be evicted. Your only other alternative is to break the lease and move and that will cost you!

You recently moved into your new rental and then decided to take a vacation in which you were gone for the entire month, so you didn't use any of the community water/sewer/gas/trash services; therefore, your bill should be zero...right? Wrong!

Most management companies and/or landlords will charge you a minimum monthly fee for those services whether you use them or not.

SURPRISE!

You just moved into a rental and the next door neighbor keeps reporting you to management because he/she is saying you're being too loud. However, you walk extra softly and keep your TV and music to a minimum. Unfortunately, the building wasn't built very well and everyone can hear everything you do no matter how hard you try to keep noise to a minimum. And there's nothing you can do about it until your lease is up, at which time you have to move...AGAIN!

Can you say cha-ching?

You picked this particular rental because you love the promise of security it came with. However, the security gates to get into and out of the community are always breaking and/or are not working for weeks at a time. This not only creates an immeasurable amount of inconvenience for you, but it could also cause you to lose your job for being late yet again. Then there is the fact that the security you thought you were getting—in reality—you're not!

You have lived in your rental for a short while and your teenager has just turned 16, which means he/she will be driving soon so you bought him/her a car and parked it in the driveway along with you and your spouse's vehicles. The next day you receive a notice from the HOA/management company that you are only allowed to have two vehicles parked in the driveway. Let's say parking one of the vehicles in the garage is not an option—now what?

Well, you have two options. Get rid of the third vehicle (which your teenager will never forgive you for) or move. Neither of these options end well. Either your teenager will hate you because "you've ruined their life," or, you will have to move which will cost you BIG!

These are just a few of the issues that could arise from choosing to rent vs buy. But believe me—there are more...lot's more!

Most experts agree it's always better to buy a home than to rent a home. So the next time you think about renting...think again!

Other Valuable Resources to consider

When is the Right Time to Buy a Home - Eric Jeanette wrote this article explaining that home ownership isn’t a decision to be taken lightly. Check out his pros and cons for buying a house sooner rather than later.

10 Questions to ask a Mortgage Lender - since you will be repaying this loan for a considerable part of your life, it helps to do thorough research and ensure that you understand all the terms and conditions before you sign the dotted line. Michelle Gibson goes over the 10 Questions a buyer must ask a mortgage lender

Why Have A Buyer's Agent When Purchasing a House - Buyer representation is vital when making one of the most significant financial decisions of your lifetime. Bill Gassett covers all the reasons why it is beneficial to hire a buyer’s agent to look out for your best interests.

About the Author

The above real estate article “Buying versus Renting a Home Which One Is More Affordable?” was written by Petra Norris of Lakeland Real Estate Group. With over 20 years of experience representing sellers and buyers with their real estate transactions, we welcome the opportunity to share our expertise and guide you through the home buying or selling process.

We service the following Central Florida areas: Lakeland, Winter Haven, Auburndale, Bartow, Lake Alfred, Kathleen, Highland City, Mulberry and Davenport. If you are considering selling your home, we welcome the opportunity to work with you and list your home with a top Lakeland FL REALTOR