A market forecast from the Instituto de Practica Empresarial (IPE) business school, in collaboration with property company Mar Real Estate, reveals a resurgent Spanish market. With the spotlight on Costa del Sol, the report also shows Mallorca properties spurring the overall upward trend. With the overall market set to grow from 5% to 7%, the Mallorca and the Balearics scene are the most prevalent positives.

According to the recent IPE report, prices on the Costa del Sol were up 10% already this year. That region represented roughly 5% of the overall Spain sales pie, but the property market in Málaga province is projected to represent as much as 20% of the overall Spanish market value by year’s end. IPE goes on to frame inventory and demand numbers in the report, but the most interesting factor of this resurgence is the Balaerics luxury market’s role since the economic downturn.

New growth, buoyed mostly by rock bottom prices and foreign demand for holiday homes, tends to be isolated in and around Mediterranean coasts. According to many experts, demand is being spurred by high net worth families abroad seeking out the most expensive properties in the region. This is reflected partly in the fact the Balaerics suffered less shortfall than other Spain sectors since the recession began. Further evidence of a resurgent market lies in the fact Palma property transactions increased by more than 50% in 2014. RealtyBizNews spoke briefly with Johannes Magar, a principal adviser on investing from Luxembourg, and a director at Mallorca Finca properties. Here’s what he had to say about luxury property yields versus less stable investment transactions:

“Looking at high end property investment on Mallorca, your typical German investor is searching for two things primarily. First, sound investment “musts” include security and stability in the short and long term. Secondly, a yield that exceeds less desirable or secure investment possibilities over term. Our luxury properties deliver on both counts, and in particular on the Balearics.”

The influx of overseas buyers from China, the UK, and elsewhere is the result of many types of stimulus. Second homes, simple yield investments, and speculative investing are just a few. However the typical property owner perceives Mallorca value, it’s clear record breaking tourism numbers for 2015 play a positive role, at least where confidence in yield is concerned. For UK second home owners in particular, subsidized mortgage payments via vacation rentals to tourists is a huge plus.

Click to view original report

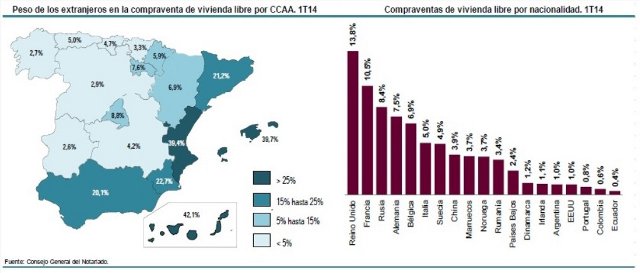

Finally, growth potential being the stimulus it always has been, stability is another reason the Balearics in particular have been a focus for foreign property buyers. Given the overall economic climate in the world, the investor figures from key countries is evidence of confidence in these coastal properties too. A report (see graphic above) via Spanish Property Insight shows that, in the first quarter of this year UK buyers accounted for 13.8 per cent of the market, followed by the French with 10.5 per cent, then Russians at 8.4 per cent, with Germans representing 7.5 per cent of sales.

We’ve no need to discuss the instability of other markets of late, the Shanghai index’s recent calamity is evidence enough smart investors need ever more trustworthy yield sources. Seeing a resurgent Luxury market in the Balearics, it’s no secret competent buyers will find those desired yields, along with the security they seek going forward.