When my stepfather died back in 2007, he left my family with a rental house that he had owned for about 22 years. The tenants were an elderly couple that had once worked for my stepfather. They were paying $250 a month rent. He had given them a special deal on low rent as part of their payment for working for him. He also allowed them to maintain the 1000 square foot property any way that they wished for that entire 22 years.

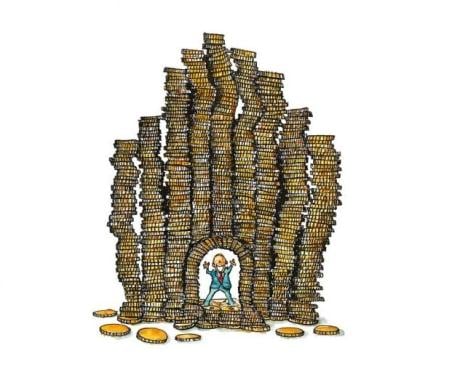

Image by HikingArtist.com via flickr.com

In early 2010, just as the housing market was heading for a crash landing, the elderly tenants both died about two weeks apart. Suddenly I found myself with a rental property that was vacant for the first time in 22 years.

But for that entire 22 years, my stepfather had allowed the tenants to maintain that property on their own, doing their own repairs, and generally modifying things any way that they pleased. As a result, when they died, I discovered that there were a myriad of items in the home which needed to be repaired, updated or replaced. Contractor estimates were close to $15,000 for all of the needed repairs.

The house is located near a small west Georgia town. It would rent for about $400 a month. Needless to say, I did not want to spend $15,000 to fix a house that would only gross $400 a month in cash flow. After taxes and insurance, it would take several years just to break even. That was just not an acceptable option. So I decided to put the property up for sale and see if another investor would buy it "as-is" and do their own repairs.

After two weeks of calling investors and marketing the house with no offers at all, I decided that perhaps all the investors were thinking the same thing I was thinking...too much money for purchase and repairs... too little rental income to justify the expense. An investor was looking at shelling out $22K for the house itself, and then putting another $10 to 15K into the repairs. It just did not make very good economic sense in a housing market that was in the process of crashing. The return on investment was simply too low. Local investor buyers were not responding.

So, I decided I'd have to get more creative. I needed to do something to turn this albatross into an eagle. I decided to offer the home "For Sale By Owner", with seller financing. I would try to find an owner-occupant who wanted to buy a home with "no qualifying".

I put a flyer inside a front window of the home, where anyone could read it, instead of a flyer-box in the front yard that curiosity seekers might empty out in a matter of hours. That way anyone who stopped by would know the asking price, and the fact that the seller was willing to finance a buyer would could verify their income, and get the repairs done at their expense, within 1 year of purchase.

I also put a basic lock box on the iron rail on the front porch, so that I could provide access to the house without having to be there in person. I also included three photos of the interior on the flyer. Simple but effective. There are plenty of good buyers out there who can't qualify for a traditional mortgage.

Within a few days I heard from a young couple who sounded really excited about the house. After viewing the inside they were ecstatic and were ready to buy what they saw as their "dream home". They were living with two very young sons in a small 2 bedroom rental trailer that was about to fall apart, and paying $400 a month rent.

Long story short, I verified their income, and asked them what they could afford for their monthly payment. They said $385 per month. I used a mortgage calculator with the asking price and the payment amount, to determine the term and interest rate.

We closed, and the young couple bought their first home. They had family members who were roofers, plumbers and painters. They got all of the work done on the home in less than 12 months, and everyone was happy. Today they are still in the home, paying $385 per month, and their escrow for taxes and insurance is included. A win-win for all involved. They got a home they could not have qualified for. I sold a home that was virtually impossible to sell, and generated a nice little cash flow to boot.

When sellers have a home to sell, they often do not think about how to make it easier for a buyer to buy the home. Many sellers merely list their home with an agent and hope the agent sells it. But when homes are more difficult to sell, it pays to consider creative options to help a good buyer.

Here are several ideas for selling a home that is difficult to sell:

1. Allow a buyer to take over your existing payments for a limited time. This is known as "subject to the existing mortgage". A buyer can take over your payments for one to several years, then get a new loan and cash you out.

2. "A Wraparound" - You create your own note for the buyer at whatever price and terms you agree on. Have the buyer make the payment to you, and you pay your mortgage company. You'll make money if you can sell for a monthly payment that is higher than your current mortgage payment.

2. Seller Financing - As in my story above, you can always "create a note" and become your own bank. This is a great cash flow method, especially when you own the property free and clear and it needs significant repairs.

3. If you owe more than your home is worth, and you need to discount your price to a buyer, consider a short sale. If this is your personal residence, a short sale will be exempt from imputed income tax until December 31st, 2012. If you are underwater, now is the time to act if you are serious about selling and getting out from under a mortgage debt.

There are all sorts of creative things you can do. For assistance with how to structure a creative real estate transaction, contact a local real estate attorney who represents real estate investors, or contact Realty Biz Consulting at 888-915-9968 / [email protected]

Remember to consider what a potential buyer will have to do to buy your home. I see this problem a lot. Even builders in this market can fail to realize how difficult it could be for most buyers to come up with a down payment and all of the cash and great credit it will take to qualify and get the deal closed. Many new houses sit unsold because it is more difficult for buyers to meet the cash and credit requirements these days.

The easier you can make it for a buyer, the faster you can sell a home that is not selling.

---------------------------------------------------------------------------------------

Donna S. Robinson is a 16 year veteran of the real estate industry. A real estate licensee, investor and market analyst who helps individuals and companies make more money with real estate. Her website is www.RealtyBizConsulting.com