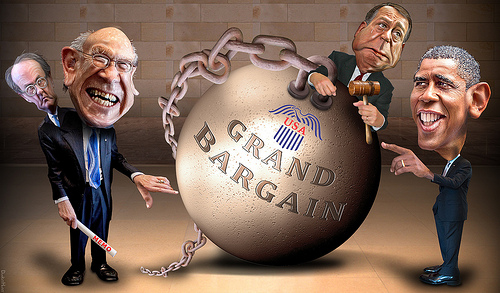

As the fiscal cliff negotiations continue over who gets to pay more income taxes, the good news is that President Obama and House Speaker Boehner have made significant progress. They've already got a framework in place for exactly how they plan to mislead the American public about the economy and inflation. Once that is done, it's relatively easy to cut the deficit and tell the public that things are OK. They've saved the day once again.

Image by DonkeyHotey via flickr.com

Yes, "real progress" has been made, over the issue of how to get money out of your pocket without you even realizing it. In fact, they are pretty much betting that since this is all happening over "the holidays" you'll be too busy worrying about sports and gift buying to pay any attention to what is actually happening in Washington. Pretty good timing eh? By the time you wake up and get over your new years eve hangover, our budget problems will all be "solved".

The solution is based upon our already-phony inflation rate, and there will be yet another "adjustment" to reflect "actual" consumer behavior. The "official" inflation rate measurement was created by the government several decades ago, to measure how much the cost of living was rising, as a way of determining yearly increases in social security, SSI and other benefit programs. The idea was that if the cost of living went up, so would benefits for seniors and the poor, thereby guaranteeing that "entitlement programs" would always keep pace with inflation. We all know this number as the "CPI" or "Consumer Price Index". But over the years, the government has gotten more and more creative with the CPI and how it is calculated.

Today there are several versions of CPI numbers. One of them in particular is the "Chained CPI". Here's a good article explaining how Chained CPI works and is calculated.

For purposes of this article, the short answer is that the chained CPI is a new type of calculation that was begun in 2002. It is a new way to calculate the CPI and help insure that the "official" CPI is lower, and therefore inflation is lower and thus you do not need as much of a cost of living adjustment,(COLA), as you might have thought.

This means that the government can reduce or eliminate a cost of living adjustment in any given year, simply by adjusting their calculations. Thus, you have "cut" the federal budget. So, in essence the new budget agreement is nothing more than agreeing on how to make the numbers "work" so that the government can reduce expenditures as needed, or implement other policies, such as printing phony money and destroy the value of the dollar without you even noticing.

As you may be aware, the inflation index is now a "favorite" benchmark for Fed Chairman Ben Bernanke, who has embarked on his own plan to save the economy by spending $85 BILLION per MONTH on a combination of mortgaged backed securities and U.S. Treasuries. Bernanke is sure that inflation will remain low, in spite of the unprecedented levels of dollars being injected into the economy by the Fed.

Bernanke is clearly not a prophet, as we all learned in 2008, but he knows that as long as both sides of the congressional aisle can agree on how to manipulate the inflation numbers, he can use "tools" such as open-ended rounds of quantitative easing - printing dollars - for as long as he deems "necessary" to help "improve employment" while keeping inflation "low". These phony calculations allow Bernanke to provide any amount of money necessary to keep the political game going, while allowing congress and the president to claim victory in fixing the economy. This is merely "the right hand washing the left hand".

Here's is a short excerpt from a detailed report on the CPI and how it has been changed:

"Federal Reserve Chairman Alan Greenspan and Michael Boskin, the chairman of the Council of Economic Advisors, were very clear as to how changing or “correcting” the CPI calculations would help to reduce the deficit. As described at the time by Robert Hershey of the New York Times, “Speaker Newt Gingrich, Republican of Georgia, suggested this week that fixing the [CPI] index, with its implications for lower spending [Social Security, etc.] and higher revenue [tax bracket adjustments], would provide maneuvering room for budget negotiators …” [vi]

“Alan Greenspan, chairman of the Federal Reserve, is among the other Government officials who have spoken optimistically about financial benefits of a more accurate [CPI] index …” [vii]

“[E]conomists believe one of the most important [CPI upside biases] is when consumers shift their buying patterns in response to changing prices, substituting one product for another. The [CPI] index is based on a fixed market basket of goods and services. But, for example, if the price on an item like steak gets too expensive, consumers may switch to hamburger.” [viii]

Yes, you read that right. The government has concocted a way, with the help of the Fed, of deliberately lowering the Consumer Price Index by saying that if steak gets too expensive you'll just switch to chicken. Problem solved. Your costs did not actually go up. Therefore, no increase in inflation. Simple huh? And you though that government was ineffective. Silly you.

Here's the entire report, as published on Shadowstats.com that provides the detailed proof on how they came up with this and how it has been developed more fully in recent years.

The net result of all this is that nothing will change where you and I are concerned. We still live in the real world. The government has concocted an alternate reality which they keep adjusting as the need arises.

But reality is that the damage is real. Since 2002 our "low" inflation rate of "only" 2.46% has accumulated a total of 27% inflation. Perhaps most folks miss the fact that inflation is cumulative. It works like compound interest, only in reverse. Instead of making money, it's a measure of money you are losing. Even if you did switch from steak to chicken, your costs of living are still officially up 27% since 2002. But chances are your income has gone down. Even if your income has gone up, unless you are making 27% more than you did in 2002, you still have less money to spend today.

The media will be trumpeting the news about who "won" and who "lost" when the fiscal cliff is averted with a last minute agreement. But make no mistake, the real agreement has already been reached. And average Americans are guaranteed to be the real losers.

--------------------------------------------------------------------------------------------------------------------------------

Donna S. Robinson is a real estate investor, author and residential market analyst located in Atlanta, GA. Follow her on twitter at donnaconsults. Her latest book, Basics Of Real Estate Investing is now available on Amazon.