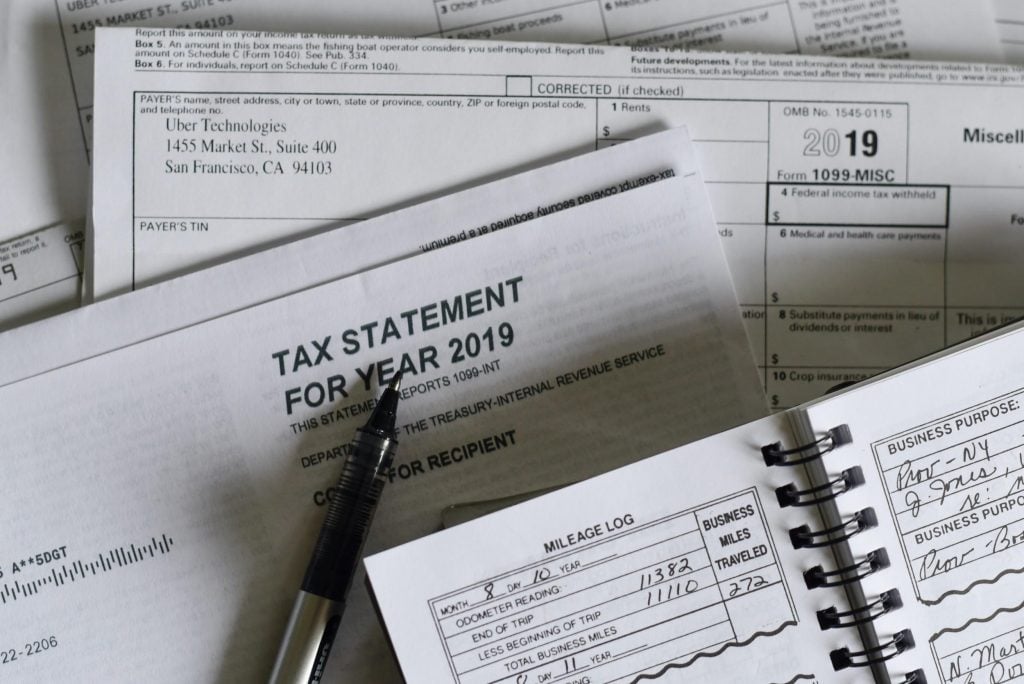

Investment properties by their very nature are supposed to bring in a profit. That is what draws so many people to add them to their investment portfolio. You still need to get the most profit out of your investment property as possible. This doesn’t just mean income from the property itself. You may qualify for tax benefits you never considered.

Don’t miss out on these real estate tax benefits on financing your first investment property. Continue reading to learn about the tax benefits you may be missing, and how those benefits compare by country.

There are several tax benefits and write-offs that may apply to your investment property.

There are more potential write-offs and benefits, but these vary significantly by country. Let’s look at the main tax benefits from the list above in more detail.

Most people who file taxes will be familiar with deductions. These are the amounts that you can write-off your taxes. For investment properties, you can usually deduct mortgage interest, property tax reduction, operating expenses, depreciation of the property, and repairs you must make to the property.

Your country of origin will determine what deductions are allowed for your investment property. For example, for UK and US residents with investment properties, deductions include repairs and maintenance, interest, motor expenses, office costs, travel and related costs, training and research, legal fees, and rental losses.

In 2017 in the UK the “wear and tear” allowance for fully furnished rental properties was taken away. Instead, you can claim the Replacement Domestic Item Relief. This allows you to deduct the cost of replacing domestic items, including moveable furniture, furnishings, appliances, and kitchenware.

Pass-through deductions apply to investment properties that are rentals most specifically. These are sometimes called passive income. In essence, pass-through deductions are the income you, the investor, made without actually physically participating in the making of the money. For rental properties, the pass-through deduction will likely be rental income.

Depreciation deductions are a great way to recoup some of your investment in a real estate property. This deduction applies to the wear and tear on your investment property. In the United States, how much you can deduct using the rental property depreciation write-off is determined by the worth of the property, the amount of time needed for the recovery of the property, and the depreciation method. The most commonly used depreciation method in the US is the Modified Accelerated Cost Recovery System (MACRS).

Depreciation is also a tax benefit for investors in the UK. You can learn more about the way it is applied to your real estate taxes by visiting small business accountants.

Capital gains can be taxed as short term or long term. They are the profit you make from the sale of your real estate. Short term capital gains are applied to properties you’ve held for up to one year. Long term capital gains apply to properties you’ve owned for longer than a year.

Capital gains affected any type of property owner. Investors should try for long term capital gains. That means you should own the property for more than a year. You will be taxed less. Also, the capital gains exclusion is a huge tax benefit that can help investors in real estate.

Finally, the tax breaks above do not apply to everyone. If you are a resident of London, the US, Australia, or Japan, you will receive most of the investment property tax breaks without any trouble. But, things begin to get murky if you live in one country and have an investment property in another. In this situation, you will likely have to pay taxes in both your country of residence and the country in which you own the investment property.

Here is a quick comparison of the investment property tax benefits and their restrictions in each country.

The UK typically taxes capital gains for rental or investment properties. The Capital Gains Tax (CGT) will apply when you sell your investment property. Otherwise, the taxes and tax benefits that apply to your property will be determined by several factors. You will be taxed differently if you are a direct or indirect owner.

The UK also distinguishes investment property taxes and reliefs based on how real estate is used. An example is a Rent a Room relief scheme. This scheme provides several tax benefits to homeowners that rent a room out of their residence. Holiday letting comes with its tax benefits as well, as long as your property is in the UK or European Economic Area.

The United States’ 2018 new tax law severely restricted what investors can write-off.

The tax world can be overwhelming and intimidating, especially for investment property owners. But, that doesn’t have to be the case. You do not need to lose money paying your taxes every year. Check out the tax benefits described in this article and their eligibility requirements. You will be amazed at the amount of tax relief that you otherwise would have missed out on.