Roam, a platform that allows homebuyers to purchase a home with a low-rate assumable mortgage, announced it has secured $1.25 million in seed funding and has officially launched its service. Roam helps buyers acquire homes with mortgage loans as low as 2%, resulting in a monthly payment of less than half of a traditional mortgage at current rates.

The seed round was led by Keith Rabois at Founders Fund, with additional investment from Eric Wu (co-founder of Opendoor), Ryan Johnson (CEO of Culdesac), and Jana Messerschmidt (Founding Partner of #ANGELS). The company has also welcomed Tim Mayopoulos, former CEO of Fannie Mae, as a senior advisor. Eric Wu and Keith Rabois have joined the board, bringing more than 40 years of real estate experience to the team.

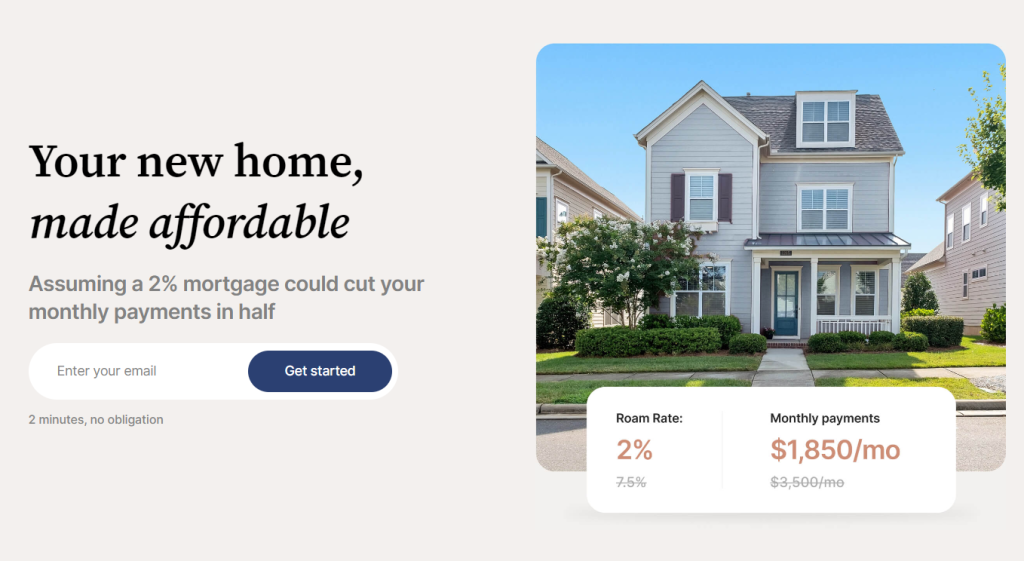

Roam offers a much-needed solution to the home affordability crisis as mortgage rates continue to rise, reaching their highest level in decades. Through the mortgage assumption process, Roam helps homebuyers secure home loans as low as 2%. Assumable mortgages allow homebuyers to take over the existing mortgage terms from the seller. It's worth noting that all government-backed loans, such as FHA and VA loans, are eligible for assumption by law, comprising about one-third of U.S. mortgages.

Raunaq Singh, Founder & CEO of Roam, stated, "Assumable mortgages are one of the most undervalued assets in America. We started Roam as a way for homebuyers to take advantage of the assumable mortgage opportunity and increase access to affordable rates so that more Americans can realize their dream of homeownership."

Roam not only helps homebuyers but also benefits sellers and real estate agents in the current challenging housing market. The high mortgage rates have made it difficult for first-time homebuyers to enter the market and have limited the pool of qualified buyers, making it harder to sell a home. Both inventory and home sales have declined to their lowest levels in over a decade.

Roam provides a marketing advantage for homeowners with an assumable mortgage by creating personalized marketing material to attract more potential buyers and better offers. Roam advertises listings to qualified buyers through their website, the only platform where buyers can easily search and discover homes with assumable mortgages.

For buyers, Roam is the only destination that helps them find available homes with low-rate assumable mortgages and manages the entire assumption process on their behalf. On average, Roam buyers save up to 50% on monthly mortgage payments compared to those who buy a home with a traditional mortgage at current rates.

"Roam has an opportunity to touch 30% of all U.S. real estate transactions in the market and provide a solution to the most important problem buyers face today, affordability," said Eric Wu, co-founder of Opendoor.

Roam provides the following benefits for sellers, buyers, and agents:

Keith Rabois, Partner at Founders Fund, explained, "With mortgage rates north of 7%, Roam offers buyers the most affordable way to purchase their next home. Though the housing environment is marked by immobility today, Roam can 2x the volume of transactions by pulling forward moves from customers that may have otherwise been on the sidelines."

Roam's service is currently available in GA, AZ, CO, TX, and FL, with plans to expand to new markets in the near future.