According to an article in economic populist.org, Mortgage Monitor figures from Black Knight Financial Services show there were 595,235 home mortgages in the foreclosure process at the end of April. This equates to 1.17% of all mortgages. The figure is down from 630,766 at the end of March, which equated to 1.25% of all loans.

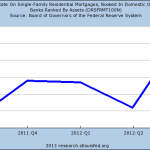

FRED Chart: Mortgage Delinquency Rates Up Again, Fundamentals Favor Investors

Just when you thought it was safe to go back into the housing market. I’ve seen numerous articles in the media on how well the housing market is picking up. Many “experts” are predicting that 2013 will be the year that a housing recovery finally picks up steam. But The St. Louis Federal Reserve Bank has some interesting housing data of their own.

FHA Delinquencies Surge To Record Levels In 3rd Quarter 2012

For the first 20 years of it’s existence the Federal Housing Administration, created in 1934, enjoyed a delinquency rate of 0.2%. As of September 2012, the delinquency rate has surged to a record 17.3%. Compare that to less than 2% for privately insured mortgage company, MGIC.

Private Mortgage Insurance Better than FHA?

Since 1 April, potential borrowers with credit disputes totaling more than $1000 have been ineligible for FHA mortgages, and today the FHA is due to increase its insurance premiums.

Flipper’s Role in Housing Bubble Exposed

A new federal report shows that house flippers – investors who bought properties in the housing boom, did them up, then sold them on for a quick profit – bear more responsibility for the housing bubble than we first thought, according to a report in the Associated Press. The Federal Reserve Bank of New York

Commercial Property Recovery is Premature, Analysts Say

Reports proclaiming the recovery of the US commercial real estate sector may well prove to be premature, despite the celebrations of some investors pronouncing its comeback. Despite a number of high profile deals involving marquee properties in some of the biggest US cities, commercial property values are still badly depressed throughout the country, and they