This is getting tiresome. The latest housing initiative announced yesterday by President Obama is just more of the same old thing. This time the major change is that the program has been "expanded" to allow for FHA (i.e. taxpayer) backing to refinance loans that were previously not insured by FHA. Do the banks themselves write this stuff?

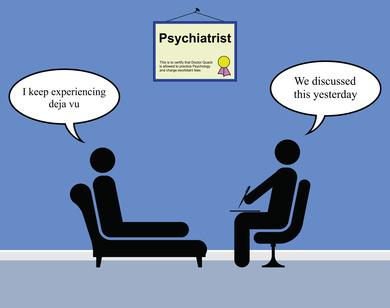

Sums up Obama's refinancing initiative perfectly! © Barry Barnes - Fotolia.com

In addition, this program can finance up to 140% of the current market value, and only applies to homeowners who are current on payments and NOT in immediate danger of foreclosure? I think I picked a bad week to give up drinking...

While this program expands slightly on the original qualifying guidelines, it still ignores the foreclosure problem, and the resulting effect that foreclosures have had on home values. Those in immediate danger of foreclosure are not eligible for this plan, and those already damaged by foreclosure are not helped either.

To pay for this program, a tax would be imposed on the banks to cover the estimated 5 to 10 billion dollar cost. Who in their right mind would believe that this tax would not be passed along to the very folks the program is supposedly helping? And 5 to 10 billion for refinancing a few more mortgages is a fraction of a drop in the bucket compared to the damage already done by the estimated 7.3 TRILLION dollar loss in home values, per a recent report by the Federal Reserve Bank of New York.

Here is NY Fed President Dudley's comment taken from his January 2012 presentation:

Since home values peaked in 2006, homeowners have lost more than half their home equity—about $7.3 trillion—and expectations of future gains have also declined. At present roughly 11 million households are in negative equity with the aggregate amount of negative equity estimated to be roughly $700 billion.5

The primary reason that this program is a waste of time in my opinion, is that it does not help the homeowners who are in danger of foreclosure, those guys are still toast. This program specifies that "qualified" homeowners who are eligible are those who have been current on their mortgage payments for the past 6 months, and have a credit score of at least 580. And the level of actual participation in this plan is something the government has refused to estimate. That's probably because it will be of little interest to anyone who understands the costs involved.

Perhaps we can all live here instead? Image courtesy dkjd via Flickr.com

I've helped a number of homeowners get their loans refinanced to lower their existing mortgage payment. But that does not mean that they owe any less. It means they will owe more in interest and financing fees. The "dirty little secret" of mortgage refinancing in these cases is that new closing costs, origination fees, and other items will likely be rolled into the new loan. This means the borrower may have a lower payment each month, but their loan will start over, and even if they've already been paying on their home for 10 years, all of that will be wiped clean and the loan will be for a brand new 30 year term.

In 2010 I succeeded in helping a homeowner who was three months behind on their payments convince their mortgage lender to stop a foreclosure and refinance their loan and lower their interest rate from 7% to 5.5%, which, when combined with a property tax appeal, lowered their monthly mortgage payment from about $750 to $580. This did help them stay in their home, since the new payment was lower than rent. But it wiped out the previous 10 years of payments which amounted to $80,000 down the tubes.

The borrower has a new 30 year mortgage, but they still owe about 150% of the current value of the home. If they do stay in the home for another 30 years, they will end up paying more than $300,000 for a home that they originally bought for a contract price of $80,000. Yes they did stop a foreclosure, and stay in the home, but until the housing market improves dramatically, this borrower will never be able to sell their home for a price high enough to pay off the new mortgage.

So refinancing plans are not really beneficial for the borrower in the long run, and this plan puts additional burdens for mortgage insurance on tax payers. These plans merely "kick the can down the road" while allowing the lenders to generate enormous profits on loans that would never have qualified for tax payer backing in the days before this crisis began.

I completely disagree. Many home owners can be helped with a refinance. Most of the loan we do are no cost loans for the exact reason you pointed out. We don't want the clients balance to be growing. Yeah the rate is slightly higher than if the paid closing costs but there is no recovery time trying to make bac the money . also we often place them in shorter term loans in this rate environment.

HI Eddie,

Since you're a mortgage guy, I can understand your disagreement. But in my years of experience as a real estate agent, I've yet to see anyone in this predicament get a no cost loan that actually reduced the total amount they owed on the mortgage. I did expect that some mortgage folks would disagree with my assessment, but it's based purely on the realities that most homeowners face when they've been late with payments and are in danger of foreclosure. As I noted in the article, this plan does not include those folks, it's only for the ones who are current on payments and have a "better" credit score than someone who has had recent delinquencies reported. I'm not attacking the mortgage industry, merely pointing out the difficult realities that most homeowners who are underwater are facing.