As a new homeowner, it's important to protect the integrity of your property. Home insurance is the most effective way to do that. For most people, a new home is their most valuable asset, and their biggest investment. It makes sense to safeguard this asset with the best home insurance policy you can get your hands on. This is easier said than done, since many homeowners policies are laden with complicated terms and conditions, insurance jargon, and a list of riders that can make your head spin. It can get confusing to say the least.

Many people mistakenly use cost as the deciding factor for home insurance policies. The cheapest homeowners insurance is not always the best homeowners insurance. It's important to scrutinize the deductibles, annual limits, and the type of coverage options possible with each homeowners insurance policy.

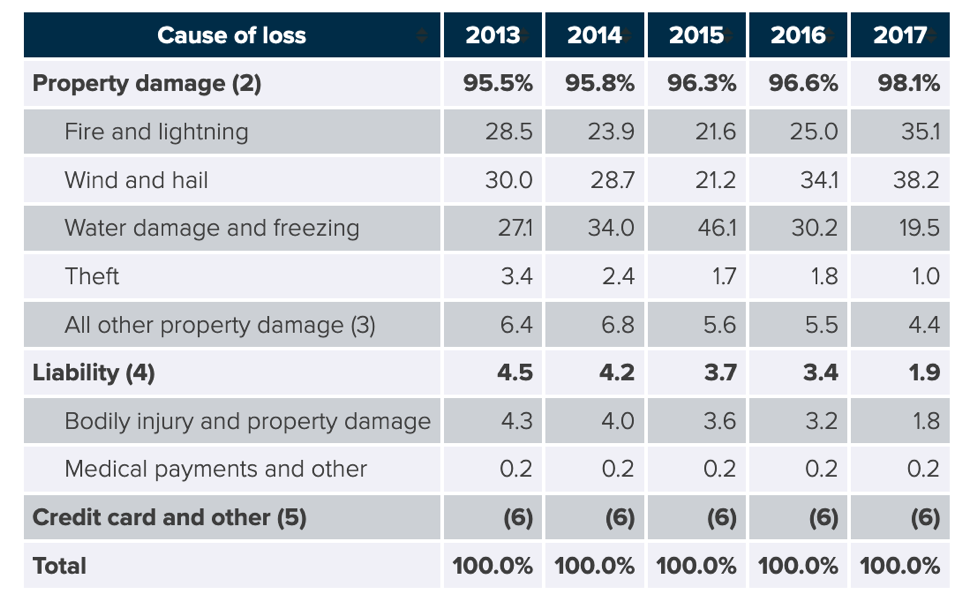

Source: ISO, a Verisk Analytics Business

It's one thing getting cheap insurance, but will it protect all of your assets? For example, you may have recently inherited a diamond-encrusted pendant from your great-grandmother, or a valuable first edition book from your uncle. These family heirlooms are worth a mint, but if you don't have the right homeowners insurance you could be seriously wanting in the event of theft, flooding, fire, or damage. Unbeknownst to many, 60% of Americans are technically underinsured. More worrying is that these folks don't even know how much insurance coverage they need to take care of these eventualities.

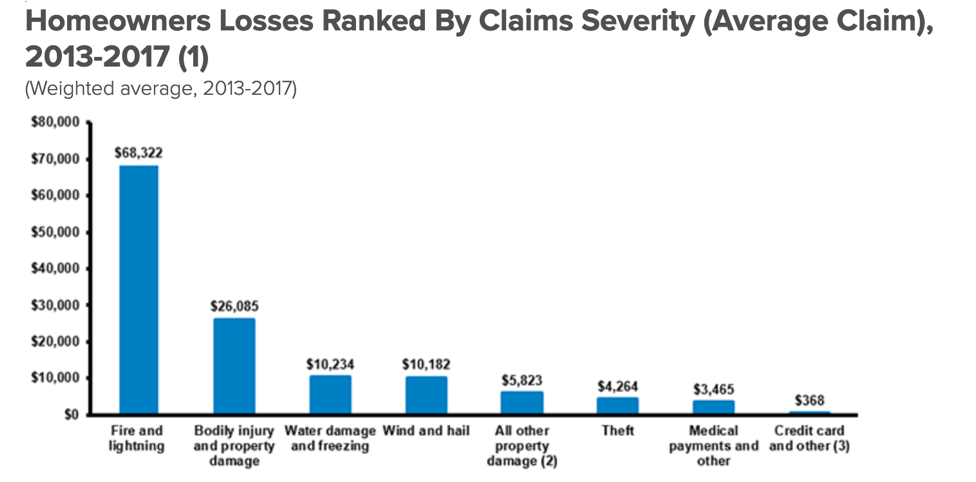

Source: ISO a Verisk Analytics Business

Fortunately, there are ways to mitigate these difficulties, navigate these obstacles, and learn the facts in an intelligible way. It's no mean feat mastering homeowners insurance policies, but there are a few steps you can follow to make sense of these protections, and pick the right policy for your needs. An education of homeowners insurance lingo begins with an understanding of certain terms and conditions found in all of these policies, namely:

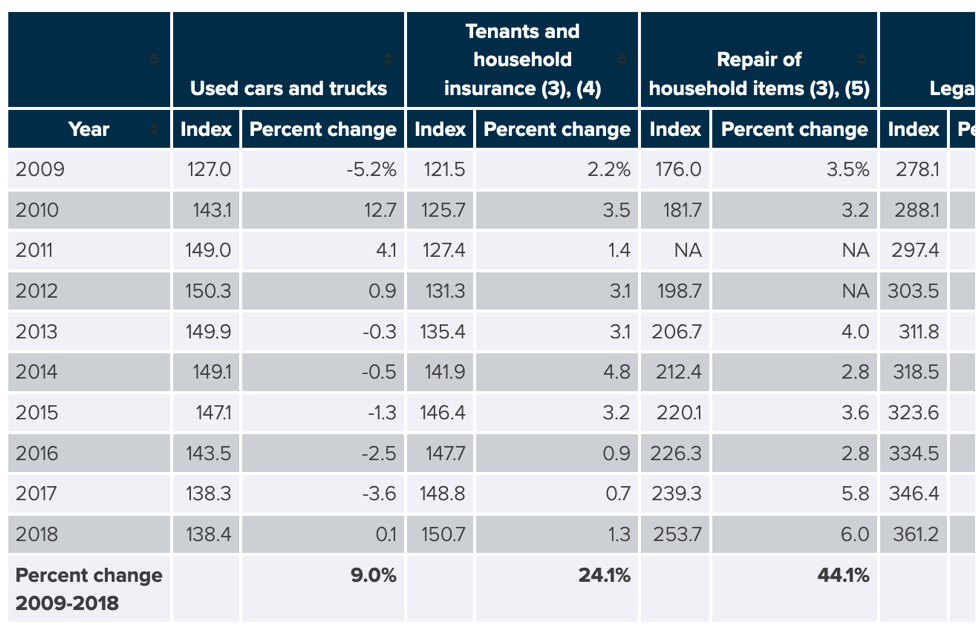

Source: US Dept of Labor, Bureau of Labor Statistics NAR (National Association of Realtors)

Dwelling coverage is the rebuilding cost associated with your home, excluding land value. If your home will cost $350,000 to rebuild, that's how much dwelling coverage you need. This ensures that you won't have any out of pocket expenses in the event of an unforeseen situation. In terms of your personal property, take an inventory of all items on your property and evaluate how much it is worth.

Always choose the appropriate level of coverage to guard against losses and damage. Various guides are available to make it easier for you to determine how much coverage you will need. Sometimes, additional coverage is required for various possessions such as a Baby Grand Piano, original artwork, expensive jewelry, or your philatelic collection. Sometimes, you may be required to purchase add-on insurance for damages that will not be covered through your regular insurance policy. These include earthquakes and floods.

Next, compare home insurance quotations to ensure that you get the best bang for your buck. When comparing homeowners insurance, always look at coverage and deductibles. The deductible is the component of your policy which requires you to pay out a non-refundable amount whenever you are making a claim. Low deductibles are typically associated with higher premiums, and high deductibles are typically associated with lower premiums.

Your insurance policy premium can always be lowered by following sensible practices. For example, install smoke detector alarms, carbon monoxide detectors, deadbolts, alarm systems, cameras, infrared cameras monitoring for water leaks, safety protections to monitor for gas leaks (if you have gas appliances) et cetera. All of these systems can easily spot anomalies before they become problems. Be sure to pick a homeowners insurance policy which accounts for these protection measures. Some people want lower monthly premiums and they are prepared to sacrifice a higher deductible to achieve this end. Others prefer low deductibles and higher premiums. It all depends how much you willing to pay out of pocket.

Many homeowners make the mistake of glossing over the important details. It's really important to read the terms and conditions of each homeowner's policy to ensure that you understand policy limitations, add-ons, deductibles, and coverage limits. Some policies are great at providing for all your needs, while many will promote low-cost options as enticements to new homeowners with very few benefits in tow.