Nearly 87% of people who buy homes finance their home purchases. While many choose 30-year loans, some choose a 15-year mortgage. Financing a home is the easiest way to buy a house. After all, it allows you to pay off your home for the next 15 to 30 years instead of saving enough money to pay cash for it.

But why choose a 15-year loan? What causes people to want a shorter loan?

Here is a guide to help you learn why a 15-year mortgage is the best option when financing a home purchase.

Many people choose 30-year mortgages to have enough time to repay their loans, but many also turn to 15-year loans. The number one reason to choose a shorter loan is to pay it off faster.

You'll see a big difference if you consider your current age and age when you repay the loan. For example, if you're 30 years old, you can repay your mortgage by age 45 or 60. Which do you prefer?

Yes, a 30-year mortgage provides a more affordable repayment plan. After all, it gives you twice as much time to repay the same amount of money. But, 30 years cut into a significant part of your life.

You might want to carefully consider your options and goals when choosing your loan duration. For example, what are your financial goals? If one of your goals is to become debt-free sooner, choose a 15-year loan.

Your mortgage payment is your largest monthly expense. Would you rather make 360 payments or 180? Many people prefer making only 180 payments to pay off their homes in half the time.

Lenders base mortgage rates on several factors, some of which are out of your control. However, other factors are within your power.

For example, your credit score is one of the primary factors lenders use when setting loan rates. Therefore, you might want to spend the next few months improving your credit before applying for a mortgage.

A higher credit score represents more creditworthiness. To a lender, this means less risk. So, this is a factor to consider first.

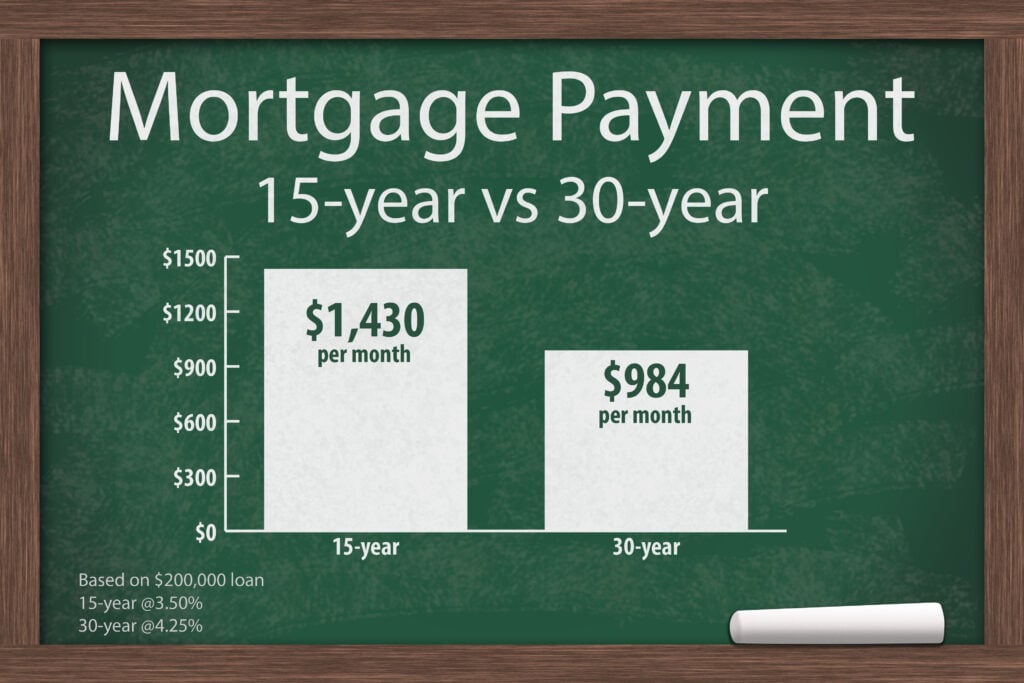

Secondly, lenders base the rates on loan durations. As a result, you'll pay a lower rate on a 15-year mortgage. You can see this if you compare a lender's rates for 15-year loans versus 30-year loans.

Lenders offer lower rates on shorter loans because they assume less risk. For example, when a person pays a loan off in 15 years instead of 30, the lender receives their money faster. As a result, they offer lower rates.

Of course, your payments will be higher because the mortgage repayments occur in less time. You can ask a lender about the payment differences between the two options.

If the payments are too high for a 15-year loan, you could always choose a lower-priced home. After all, your payments will be lower if you finance less money.

One of the top perks of choosing a shorter loan is the money you'll save on interest costs. Lenders base the mortgage interest you pay on several things, including the principal balance and interest rate.

Because you repay a 15-year loan faster, your principal balance decreases faster. As a result, you spend less money on interest. You can talk to a lender to learn the difference, but it might surprise you.

Additionally, you save money on interest by getting a lower interest rate for choosing a shorter loan. When you compare the difference in interest charges, you'll see a large difference.

Of course, you can always pay extra money toward your principal balance. Lenders often call this a principal-only mortgage payment. If you do this, you'll decrease your principal balance faster, helping you save even more.

Repaying a mortgage takes time, but 15 years is half the amount of time as 30. Some people lean toward 15-year loans for a different reason than the ones listed so far.

Each month when you make your mortgage payment, you're paying part of your principal balance. As a result, you build equity in your home each time you make payment.

If you pay off your home in 15 years, you'll own your house outright, leaving you with an investment. Therefore, many people view home purchases as a forced way to save money.

Home values tend to increase over time, so buying a house is an investment. When you sign the mortgage documents, you agree to repay this money. So, in a sense, a mortgage forces you to invest money.

Therefore, you'll save even more money by choosing a 15-year loan, as your payments will be higher than if you had a longer loan.

The final consideration of a 15-year mortgage is financial freedom. Repaying a loan over 15 years is a commitment, but it's a much shorter commitment than agreeing to repay the money over 30 years.

The result is that you'll acquire financial freedom in half the time. When you make your final house payment in 15 years, you can begin investing your money in your retirement accounts or other investments.

A new home purchase will likely be the most expensive thing you buy. Naturally, therefore, you'll probably need to finance it.

However, getting a 15-year mortgage might be in your best interest, as you can see all the benefits they offer. Would you like to learn more about interest rates, loan options, and real estate?

Feel free to browse through our blog for more helpful topics and insight about loans and real estate.