Although we might be awash with foreclosed homes at the moment, the best of these properties aren’t always so easy for buyers to get their hands on. One of the main problems is that foreclosures are available at such big discounts – perhaps as much as 35% less than the market rate – meaning that investors with cash in hand are often able to trump the rest of us.

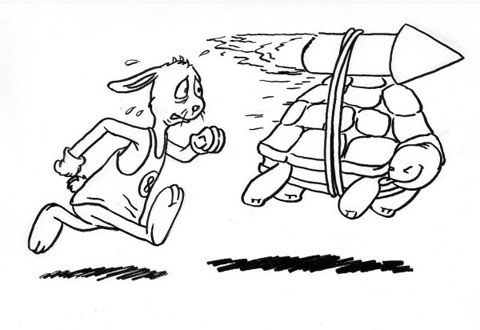

Tips for winning the foreclosure race. Image courtesy Duffy via Flickr.com

Still, those buyers who do see a foreclosed home for sale that they absolutely have to have, all is not lost. The following tips will give them a great chance to beat the competition…

First things first, serious buyers need to make sure they get the first look at the property they want. Fannie Mae and Freddie Mac offer an excellent program called First Look which allows first-time buyers to do just that. Open to those looking for a primary residence while in need of financing, the program allows those who qualify to snatch a first look at bank-owned homes before the investors can catch a glimpse. Interested buyers are granted a 15-day window in which to make their offer before the investors come in.

Aside from getting the first look, it’s also important to make a serious offer. There should be no pussy footing around when it comes to securing a place that seems ideal. Foreclosures are often in very high demand, and as such, lowball offers aren’t going to be entertained. Instead of trying to scrimp and save, buyers should offer as much, or near to, whatever they are prepared to pay in the first place.

Offering a larger than expected deposit is a sure-fire tactic to get ahead of the competition. Image courtesy Ioswl via Flickr.com

One final thing buyers can do to really get the bank’s attention is to offer a sizeable deposit on the property they want. By offering a larger-than-normal deposit as a sign of good faith, the bank will almost certainly be inclined to go ahead with the deal, so long as the price is right.