Home builders say they have adopted a range of tactics to try and protect themselves from the rising cost of lumber, which is perhaps the single-most important building material that goes into any new home.

The price of lumber has risen dramatically over the last year and remains extremely volatile, and that’s having a negative impact on both the new home and remodeling markets, experts say. The price of lumber almost doubled over a four-month period in min-2020 and even now it continues to rise, albeit more slowly.

Home builders say that the price and availability of building materials is now the biggest challenge they face at a time when the real estate industry is screaming for more housing inventory to meet strong buyer demand.

One of the problems some builders have faced is that they often try to sell their homes before they have been built. But with lumber costs growing so fast, it means that by the time they have actually built the home they had already sold, the agreed price means the builder is no longer making a profit on it, and in some cases, may even lose money on the deal.

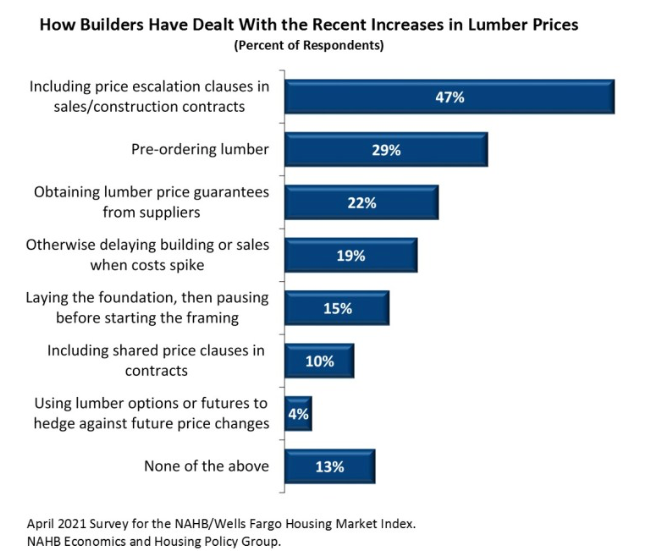

Now, to try and protect themselves some 47% of home builders say they have resorted to including “price escalation clauses” in their sales contracts, according to the most recent National Association of Home Builders and Wells Fargo Housing Market Index survey. A price escalation clause means that the buyer will have to stump up more cash to purchase their home once it has been completed, if the price of lumber rose by a substantial margin during the period between the contract signing and the house being finished.

Another 10% of builders said they include what’s called a shared price clause, which are similar to the price escalation clause in that they tie the final price of the house to the cost of the building materials.

“The difference is that, in the typical shared price clause, the home builder agrees to absorb part of the material price increase, with the home buyer covering the rest,” explained Paul Emrath, vice president of survey and housing policy research, in the NAHB’s Eye on Housing blog.

The shared price clause is likely to b beneficial for some builders, as sharing any price increase can help to ensure they won’t lose buyers who otherwise would not be able to afford to take on the added costs alone.

Such clauses are, unfortunately, one of the few options that home builders have to protect themselves from the rapid lumber price rises. While 19% of builders say they just delay building or selling when prices jump, others have reported pre-ordering large amounts of lumber to avoid the rising costs, with 22% obtaining price guarantees from their suppliers. But those guarantees typically only last for two months, the NAHB’s survey found.

A small number of building firms have also taken to the stock market to buy lumber options and futures to hedge against any price increases, but that option is a gamble and comes with a financial risk should lumber prices suddenly fall.

Several years ago I had read about an upcoming boom in metal 2x4's. Has that really ever happened and if so, has that had any effect on the wood crisis?