Wildfires raging in Western Canada could send lumber prices sky high again in a move that would snuff out home buyer’s hopes of some price relief.

Lumber prices had been cooling in recent weeks leading to hopes that new home prices would come down. The costs of remodeling projects were also set to benefit. But whatever relief comes may well be limited, as lumber producers have warned that price rises could be on the horizon if Canada’s wildfires aren’t stopped.

The wildfires are currently causing havoc in British Columbia, which is the main softwood lumber-producing region in North America. Three of the largest North American lumber producers are located there, including West Fraser Timber and Canfor, which rank first and second in sales, an Interfor, which ranks sixth.

On Tuesday, Canfor announced that it’s planning to curtail production at its sawmills due to the wildfires.

“The wildfires burning in western Canada are significantly impacting the supply chain and our ability to transport product to market,” said Canfor Executive Vice President Stephen Mackie this week.

Experts say other lumber producers are likely to scale back production due to the wildfires spreading all along Canada’s West Coast.

British Columbia exports around 90% of its total output, which means any disruption there is bound to send prices up.

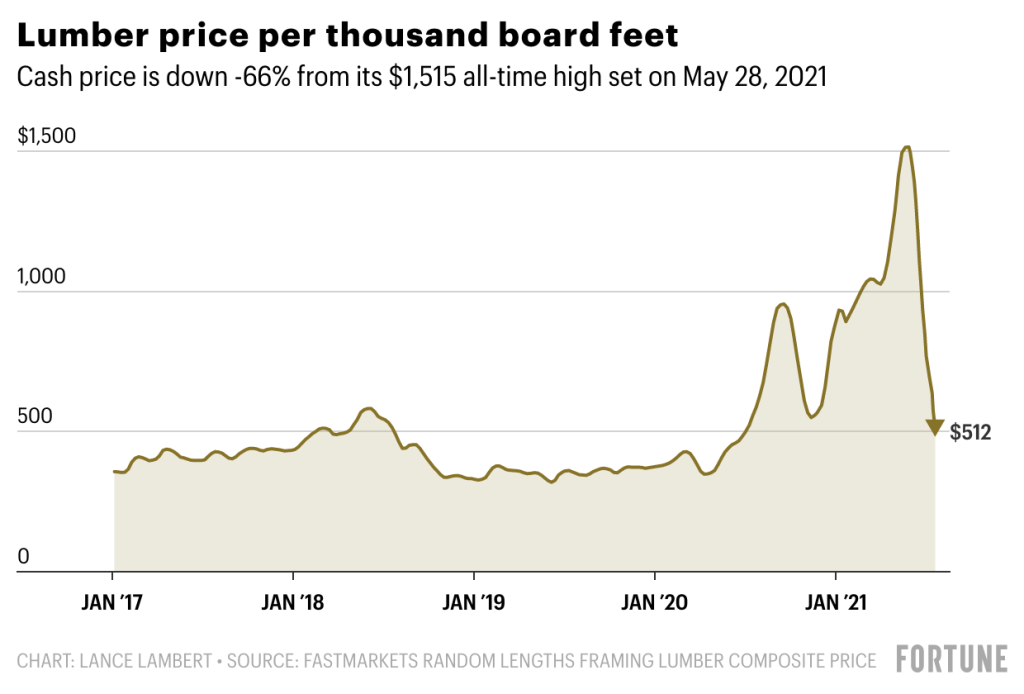

Alarm bells are already ringing, with the September futures contract price up 19% to $647 per thousand board feet or two-by-fours. On Wednesday and Thursday, trading was halted as futures hit their daily increase limits.

Lumber futures are the leading indicator of where prices are usually headed. But industry insiders told Fortune they can’t be sure if this is just an uptick or the beginning of another run on lumber prices.

Earlier this year, lumber prices hit record highs amid crushing demand from builders. As a result, new home costs in the U.S. also hit record highs. However, since May lumber prices have fallen sharply, and by the middle of July were down almost 70% from their record high. Hopes were high that home builders would benefit and be able to reduce their costs, passing them on to end buyers.

Canadian softwood lumber is more favored by home builders than the yellow Pine that’s plentiful in the southern U.S. However, softwood production has already been hampered in recent years by previous wildfires, beetle infestations and the slow growth rate of spruce trees.