Investors have been throwing record-breaking amounts of cash into real estate, spending $63.6 billion on U.S. homes in the third quarter – up 78% from a year ago, according to a new Redfin study published this week.

The report found investors bought a combined 90,215 homes in Q3, up 80.2% from the same period one year ago. Under Redfin’s definition, an investor is any institution or business that purchases residential homes.

Redfin senior economist Sheharyar Bokhari said investors were being enticed into real estate by rising home prices and the belief they can realize some quick profits, either by flipping them or renting them out. “Those same factors have pushed more Americans to rent, which also creates opportunities for investors,” he added.

Median home sale prices jumped 13.9% year-over-year during September. At the same time, average monthly rents have gained 10.7%, the fastest rent growth in two years.

Redfin’s report notes that it has become challenging for individual home buyers to compete with investors, many of whom are “cash-rich” and can bid on properties without the need for financing. Of the 90,215 homes they purchased in the quarter, more than three-quarters were paid for in cash.

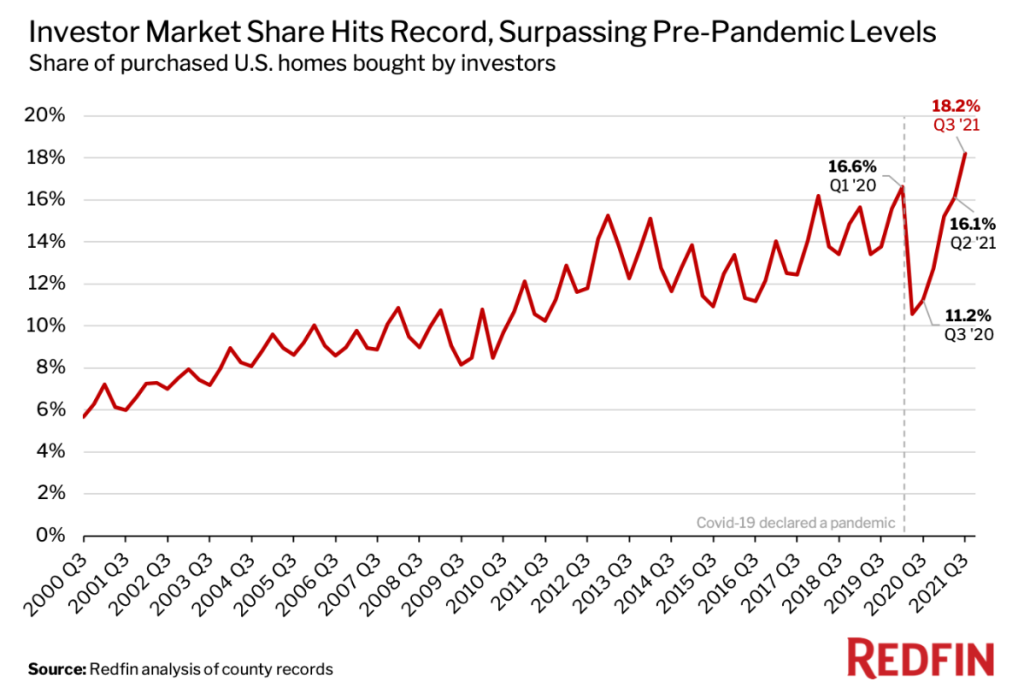

The rise in investor home buying means they accounted for 18.2% of all U.S. homes snapped up in the third quarter, seven percentage points higher than a year ago, Redfin said.

In many markets investor’s share was even higher than that average though. For instance in Atlanta, GA, investors purchased 32% of all homes in Q3, while in Phoenix, AZ they accounted for 31.7% of all homes bought. On the other hand, in Providence, RI, investors only purchased 5.4% of homes sold during the quarter.

Investors are spending more on their homes too. They paid a median price of $438,770 on the homes they purchased, up 5.3% from a year ago. Regarding the types of homes they bought, single-family properties accounted for the bulk of them at 74.4%, with condos and co-ops making up 16.9% of the total, townhouses 5.4% and multifamily homes just 3.4%.

Interestingly, investors were shown to be more willing to purchase homes considered to be at risk of climate change. Redfin said 65.2% of homes they bought were considered to have “high heat risk”, while 64.3% had “high storm risk” and 7.1% faced “high drought risk”. In all three situations, non-investors were less likely to buy those types of homes.

The report said the vast majority of residential real estate investors are small businesses buying up local homes. According to Redfin, institutional investors own just 2% of all U.S. single-family homes, the vast majority of which are being rented out.