The technology-powered real estate brokerage Compass launched its initial public offering Thursday closing its first day of trading at $20.15 per share, around 12% higher than its IPO price.

Compass priced its stock at $18 per share, at the low end of its target range of $18 and $19. That range itself had been revised downwards on Wednesday from an initial range of between $23 and $26.

The company’s shares began the day trading at $21.25, about 22% higher than its IPO price. Altogether, Compass raised $450 million from the IPO, it said.

In an interview with Crunchbase, Compass Chief Executive Robert Reffkin said he was pleased with the stock performance on the first day of trading. “We met our goal,” he said. “The goal wasn’t a price or a valuation, the goal was raising a certain amount of capital to fund the business.”

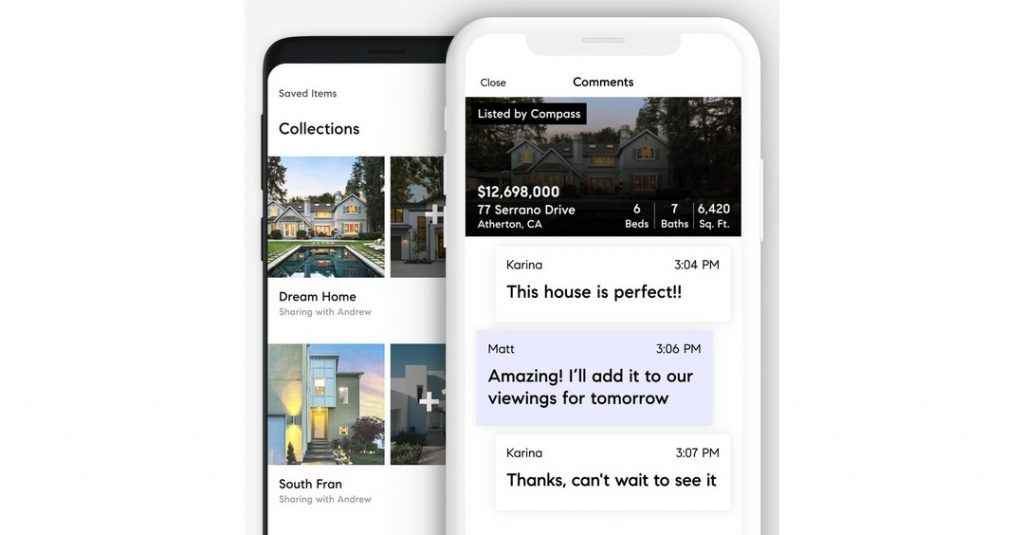

Compass operates similarly to most traditional real estate brokerages, but it sets itself apart by providing a suite of digital tools its real estate agents can use to better market themselves and their listings. Its customer relationship management platform provides, among other things, tools to make videos, ads and newsletters.

Reffkin said he was inspired by his mother, who has decades of experience as a real estate agent. She now works with Compass, he told Crunchbase.

“I saw at a young age that, on one hand she’s an entrepreneur, and all agents are … but on the other hand, they’re an underserved customer base,” Reffkin said. “I saw her struggle because she didn’t have the tools she needed.”

When asked about whether Compass sees itself as a real estate company or a tech platform, Reffkin said it sees itself as helping agents to be successful, which it primarily does through its technology platform. He said that most traditional brokerages provide very limited tech support, and the average agent uses 9 different software platforms to do their job. He said Compass is to real estate agents what Shopify is to online sellers.

“If you’re a merchant, you can get everything you need from Shopify,” Reffkin said. “Agents need and deserve the same.”

Compass pulled in a huge amount of venture capital before its IPO that allowed it to grow its business while running at a loss. Its most recent funding round was a $450 million investment in 2019 led by SoftBank Group’s Vision Fund.

The company’s next task is to try and achieve a profit, and luckily for investors it does seem to be on the way to achieving that goal. Its IPO filing revealed that it lost $270.2 million in 2020, down from a loss of $388 million in 2019.