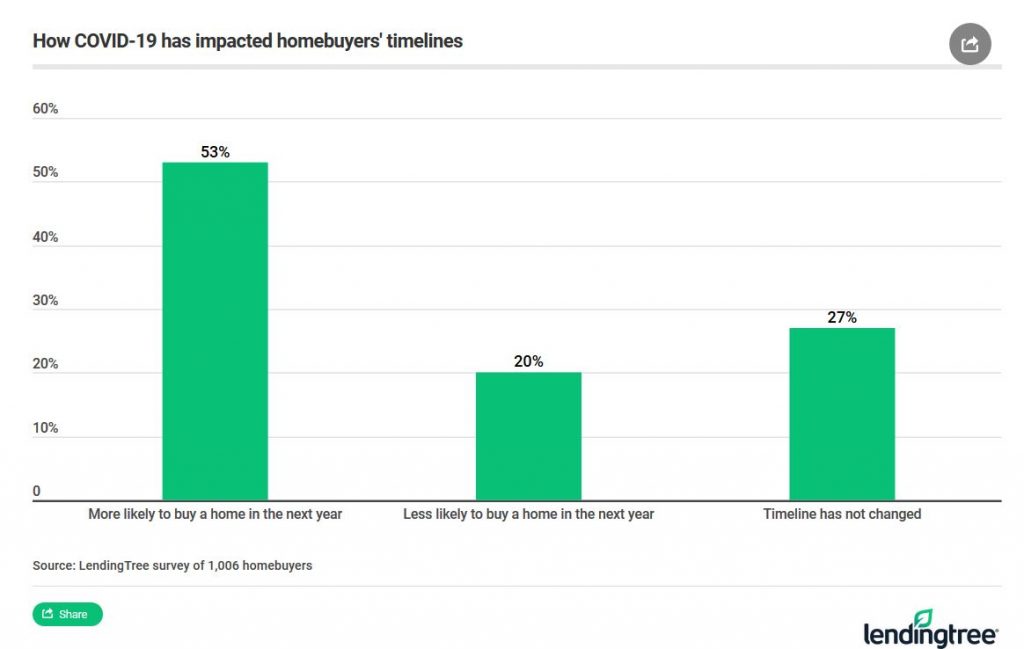

Home buyers aren’t being scared off by the COVID-19 pandemic. On the contrary, 53% of those quizzed in a recent survey by LendingTree said they’re more likely to buy a home in the next year because of the coronavirus outbreak.

The most eager to buy appear to be first-time buyers and millennials, the survey found.

The main reasons for wanting to buy as soon as possible include taking advantage of the current low mortgage rates, cited by 67% of respondents, and being able to save for a larger down payment due to reduced spending, cited by 32%. In addition, there is a perception that home prices are lower, according to 30% of buyers. Also, being confined to home as a result of the pandemic has made the prospect of searching for home packages more appealing, the survey found.

People’s home shopping habits are also being influenced by the COVID-19 pandemic, the survey shows. The majority of respondents in LendingTree’s survey said the coronavirus has impacted how much they’re planning to spend on a new home. Some 44% said they’re looking at a less expensive home, while 21% said they want to buy one that’s more expensive. Broken out, 28% of first-time buyers say they’ll purchase a pricier home compared to just 17% of repeat buyers.

Some buyers are more comfortable about the idea of buying a property sight unseen. Around 30% of buyers said they could buy a home with actually seeing it in person, and 60% said they’ve toured at least one home virtually since the pandemic began.

However, one big potential roadblock in the path to homeownership is actually being able to qualify for a mortgage. According to the survey, 44% of buyers say they’re worried about this because of the effect of the pandemic on their income. Of those, millennials and first-time buyers expressed the most concern.

They aren’t being helped by the fact that some lenders have began to tighten access to credit since the coronavirus emerged. The Mortgage Bankers Association reports that access to credit fell by 12.2% in April.