The latest report from realtor.com® reveals the continued cooling off of the U.S. housing market with 15% of listings showing price reductions and 10% increases in inventory. According to the report, listing price growth has slowed and price cuts have increased.

For the month of December, home actually held its own compared with last year's selling pace, but the realtor.com® data showed homes selling faster in December of 2017. The report spotlighted properties in San Jose, Calif., Seattle and Nashville, Tenn., as having typically spent 14, 10 and six more days on the market this December. Even though there were some bright spots, like Birmingham, Ala., Milwaukee and Richmond, Va. homes turning over more quickly, the experts revealed the overall negativity factors. Danielle Hale, chief economist for realtor.com® offered this:

"Sellers are adjusting their strategies, especially in slowing, pricey markets with

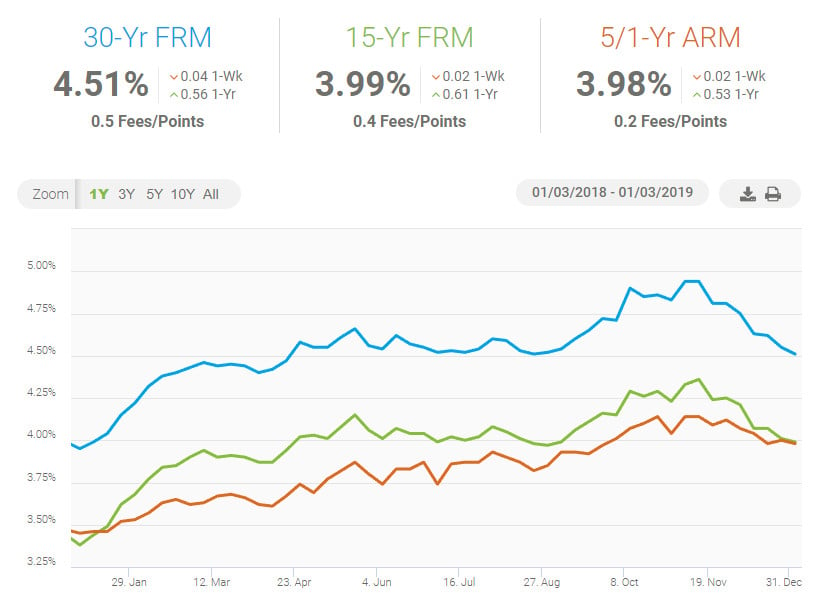

growing availability of homes for sale. Although buyers may not find a bargain, the price discounts and recently lower borrowing costs may entice upper-tier buyers back into the market. By contrast, entry-level shoppers continue to contend withdeclining availability of homes for purchase, albeit at a slower rate."

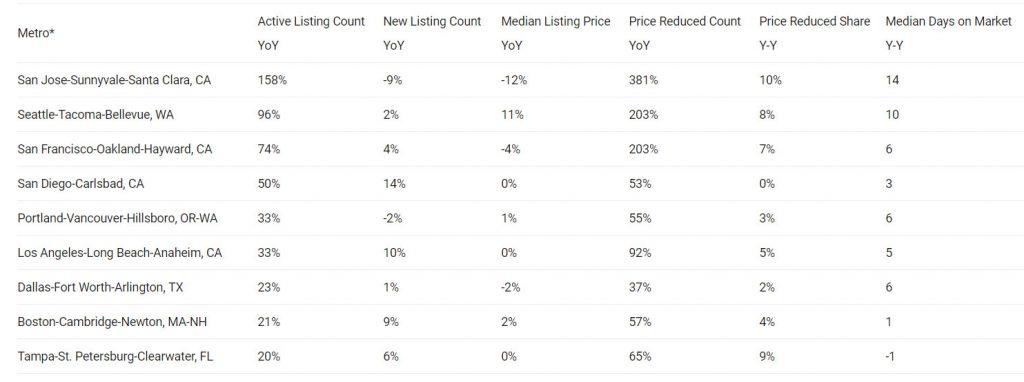

Nationally, 38 of the 45 top markets saw an increase in the share of price reductions. In addition, the percentage of listings that saw price reductions increased to 15 percent in December, a figure which is up from 13 percent a year ago. Charlotte, N.C., topped the list with the share of price reductions growing by 10 percent, from 14 percent last year to 24 percent in December. The southern city was followed by San Jose (+10 percent), Tampa (+9 percent), Phoenix (+9 percent) and Seattle (+8 percent).

Even the good news of the median U.S. listing price growing by 7 percent year-over-year to $289,000 in December comes with a

Sliding down the list of median listing prices were San Jose, Calif., and San Francisco, which were down 12 percent and 4 percent, or $130,000 and $33,000, respectively. And the report also showed Austin, Texas, Houston, Dallas, Nashville, Tenn., Charlotte, N.C., and Jacksonville, Fla. markets cooling off. The abbreviated list below from realtor.com® can be seen in full here.

Data from the U.S. Department of

Like I said, the potential for mortgage rates falling is a "glimmer" of hope for the coming months. However, data from the National Association of Realtors shows a months long housing shortage is coming to an end, a trend that does not bode well for price escalations. I think we are seeing a kind of equilibrium, which some experts claim is a truly sustainable housing picture forming. Let's hope that the economy remains strong and the housing supply continues to increase, so that as consumers we can see a sustainable price rise in the future.