Digital closing software startup Endpoint Closing Inc. has raised $150 million in funding from its parent company First American Financial Corp., it said this week.

The round brings Endpoint’s total amount raised to $220 million, and follows a $40 million raise in November 2020.

Founded in 2018, Los Angeles-based Endpoint was developed by First American in collaborationwith BCG Digital Ventures, which is the investment and incubation arm of Boston Consulting Group.

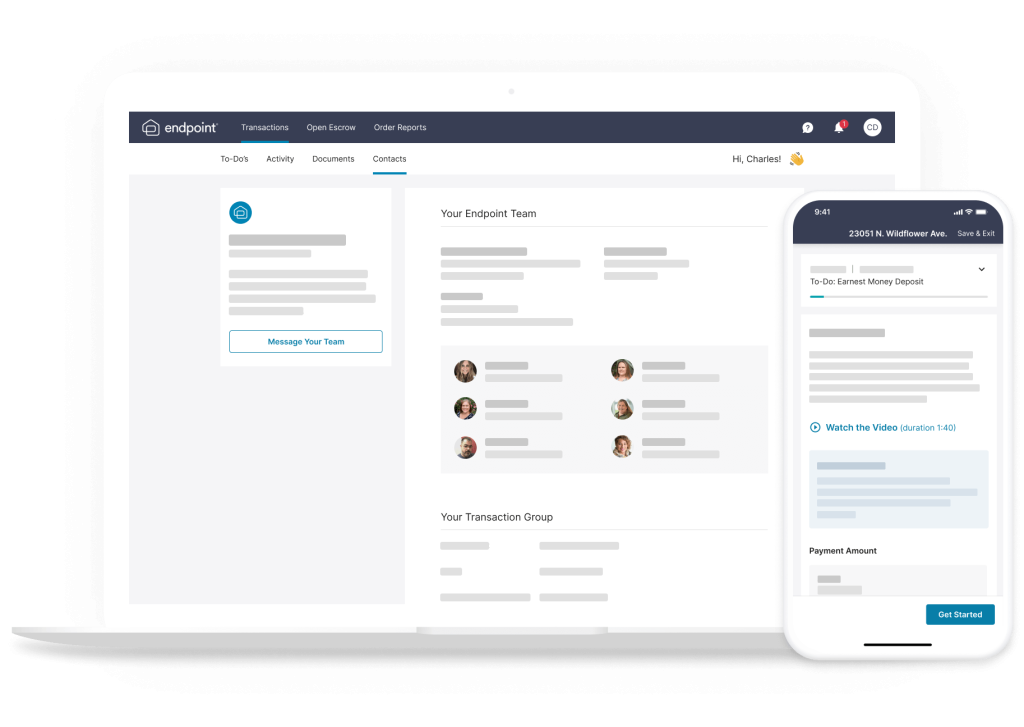

Endpoint sells a mobile-backed platform that relies on artificial intelligence-powered smarts to streamline document submission and handling and speed up the time it takes to close on a home sale. With that, it frees up title and escrow professionals to handle exceptions and take care of their customers.

The company officially launched in November 2019 and claims to have helped real estate professional close on more than $2.5 billion worth of transactions so far.

First American Chief Executive Dennis Gilmore said Endpoint’s impressive growth thus far reflects his own company’s commitment to leading the digital transformation of the title and settlement industry. “This next phase of investment will further accelerate our overall effort to improve the process of transacting real estate,” he said.

Endpoint’s platform is aimed at proptech companies, brokers and agents, as well as home buyers and sellers. For the first category, it simplifies the entire closing process they need to manage by streamlining document submission and asking for key information earlier, ensuring deals can conclude on time with minimal hassle.

For buyers and sellers meanwhile, Endpoint’s solution provides full visibility into the closing process so both parties always know what’s coming next and what they need to prepare. It also has a team of experts on hand to answer any questions people may have, and it can even facilitate instant money transfers through its platform.

Endpoint also offers a closing cost calculator on its website so buyers and sellers can get an accurate estimate of how much the transaction is going to cost them.

The company recently updated its software with a new application programming interface that broadens its integration capabilities with other proptech and brokerage’s platforms.

Endpoint makes money by charging a flat escrow fee that covers all of the recording services, mobile notary, document preparation and wire services it provides. Its costs range from $550 per side in Texas, to $1,000 per side in Washington and California, irrespective of the price of the home.

Endpoint’s software has been a big hit, with the company’s growth resulting in it doubling its workforce and expanding into new markets in Northern California and Texas, in addition to its original markets in Washington, Arizona and Southern California.

The company currently has more than 80 job openings for positions including escrow officers, software engineers, title officers and business development managers. Endpoint said it’s planning to spend its new funds to fill some of these positions and will also look to develop its title automation capabilities.

Endpoint CEO Scott Martino said today’s investment supports the company’s mission to deliver a fully digitized closing experiences to even more buyers, sellers and real estate pros.

“The capital will fuel enhancements designed to further our position as the go-to company for agents and proptech companies focused on providing a purchase experience that integrates state-of-the-art technology and superior customer service,” Martino promised.