A survey by Zillow has found that economists and housing experts are split on what’s in store for the residential real estate market in 2022, with around half predicting that home sales will rise, and the others believing sales will decline.

The confusion is due to worsening housing affordability and uncertainty over whether or not housing inventory will grow this year or remain low.

When asked whether sales will rise or fall in 2022 compared to 2021, 41% of participants in the latest Zillow Home Price Expectations Survey said sales will grow, 41% predict a slowdown, and 18% believe sales will remain roughly the same.

There were about 6.32 million homes sold from January through November of 2021, the most sales in that time period since 2006. Of those, roughly 5.61 million were existing homes. Zillow's own forecast calls for sales of existing homes to increase slightly in 2022, drawing on recent sales performance, household formation rates and the expectation that mortgage rates will remain relatively low, offering attractive financing for home buyers.

"In America's frenzied pandemic-era housing market, buyers and sellers have both defied expectations: Buyers have forged on in the face of record-fast price appreciation, and homeowners have steadfastly demurred from cashing in on this selling opportunity," said Jeff Tucker, senior economist at Zillow. "The outlook for home sales in 2022 hinges on which side yields first. If buyers finally balk at unaffordable prices, sales volumes could fall. But if homeowners finally start listing their homes en masse, we could see a sales bonanza, cooling the pace of appreciation. Our expert survey panel was split right down the middle on which scenario to expect."

Panelists who foresee lower sales in 2022 point to financial strains on buyers as the main driving factors. Worsening home affordability was cited by 54% of respondents as the most important reason for a sales decline, while higher mortgage rates were noted by 28%. As home values skyrocketed in 2021 — up a record 19.3% year over year in November — affordability saw its greatest decline since at least 2014.

Among those panelists who anticipate an uptick in sales, additional inventory is overwhelmingly cited as the key; 51% said an increase in existing homes listed for sale will be the most important factor, while 21% pointed to more new homes being completed and listed for sale. Inventory began to recover through the summer of 2021, but lost ground in the fall.

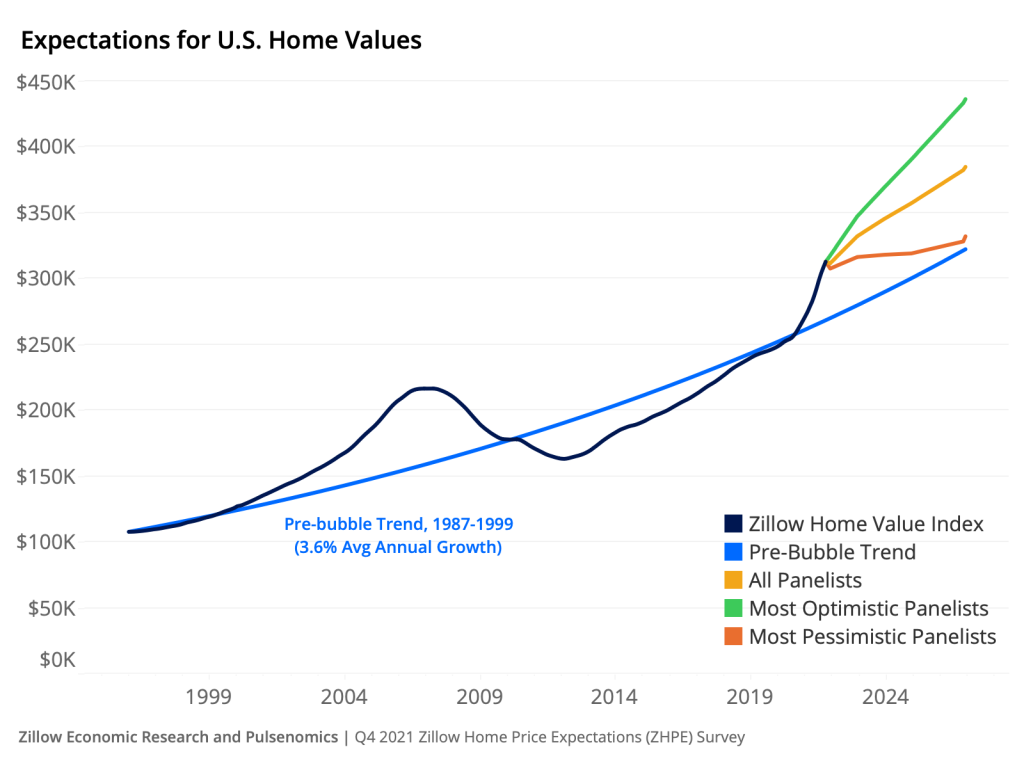

Although every respondent in this latest survey expects nationwide home price appreciation to slow in 2022 from last year's record-breaking pace, the average of their long-term projections remains among the most bullish outlooks for home values in the ZHPES’ history. On average, panelists expect home values to grow another 6.6% this year, and by 23.5% over the coming five years.

"Although a handful of experts foresee a modest price correction on the horizon, none expect a crash, even as the confluence of unusual forces impacting U.S. housing markets continues to generate significant uncertainty," said Pulsenomics founder Terry Loebs.

Loebs said the range of home price predictions from panel participants is the widest he's ever seen. The most optimistic group of experts expects more than 37% cumulative home value appreciation through 2026, while the most pessimistic group expects a gain of less than 8% over the same period.