Real estate investing data startup Entera Holdings Ltd. has raised $32 million in a Series A funding round, bringing its total amount raised to $39.5 million following an earlier seed funding round.

The round was led by Goldman Sachs investment arm, Goldman Sachs Asset Management, with participation from Bullpen Capital, Craft Ventures and Valuestream Ventures.

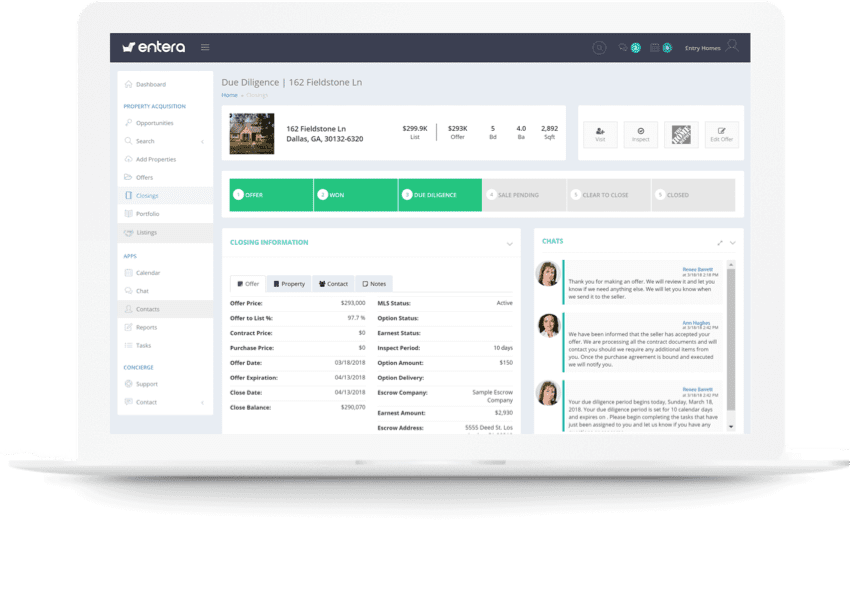

Entera was founded by its Chief Executive Officer Martin Kay, and sells artificial intelligence-powered software that institutional investors use to analyze property records. This helps them to buy single-family homes that meet their purchase criteria, and makes it far less time consuming for them to do business, the company says. Entera’s clients include the single-family home rental giant Invitation Homes.

Entera said its software can also be used to complete real estate transactions, and that it has helped buyers to acquire around $1 billion worth of homes since its launch in 2018.

Kay told Bloomberg in an interview last week that Entera has seen “insatiable demand” from its customers, many of whom are looking to spend a bunch of money, he insisted. “We are trying to build everything we need to service existing customers and continue to grow,” he added.

Kay explained that for institutional investors, the single-family home market has been difficult for them to enter due to the time needed to investigate each asset. Single-family homes are tricky to find and acquire and also expensive to manage. That, he said, has led to unreliable returns on investment compared to other real estate classes.

“Our mission is to change this dynamic. With our AI-driven ideation, decisioning and transaction technology, coupled with our team of local real estate professionals, we empower investors to understand consumer demand, seize buying opportunities and deliver predictable returns,” Kay said.

“We think we have cracked the code on how to intelligently find, buy and operate single-family homes using a centralized, full service platform,” he added.

Paul Pate, vice president of equity growth at Goldman Sachs Asset Management, told Bloomberg that the bank was backing Entera because its platform does two things – it fins homes and then it helps investors to complete transactions. “As a result, Entera is both a beneficiary and an enabler of the growing single-family rental asset class,” he said.

Entera said the raise reflects its strong momentum, which has seen transaction volume grow by around five times for each year it has been in business. Looking forward, Entera aid it plans to use the funding to support its growth as full service software-as-a-service platform for professional single-family home investors.