U.S. Census Bureau data published this week shows that the homeownership rate fell slightly to 64.1%, despite the fact that the number of new households is rising. That’s because most new household formations come from rentals, the number of which was larger than the amount of new homeowners for the first time since 2016.

“The housing shortage, especially at the level of moderately priced homes, has prevented financially capable renters from owning,” Lawrence Yun, chief economist of the National Association of Realtors, said in a statement about the latest homeownership rate numbers. “More home construction is needed to relieve the housing shortage and allow more Americans to participate in the wealth gains associated with ownership.”

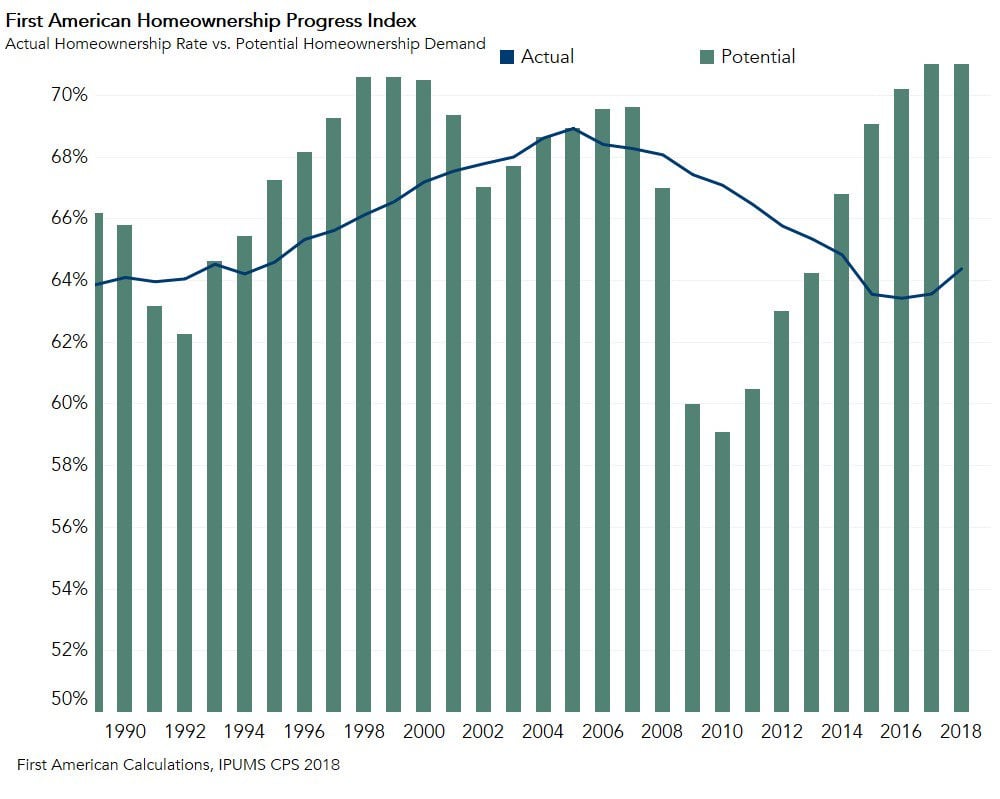

Mark Fleming, chief economist of First American, said in another report this month that the homeownership rate is below what it should be at present. In 2018, he said the homeownership rate was underperforming potential demand by 8.7%, mainly due to the lifestyle choices of young adults.

The problem is that millennials are trailing previous generations when it comes to homeownership. Many are choosing to delay getting married and having kids, which are often the main triggers for buying a home. As such, Fleming said there’s a six percentage point difference between millennials and members of Generation X at 30-years old.

“But the bulk of millennials have yet to turn 30, which signals higher potential homeownership demand may be on the horizon,” he said.

The largest number of millennials by birth year will turn 30 in 2020, which is the prime age for buying a home, Fleming said. Even better, many are well prepared to make the step up to homeownership, he added. For example, millennials are the most educated generation, and have the highest incomes compared to older generations at the same age. The inflation-adjusted income for 37 year old millennials is $77,000, compared to $72,000 for Generation X and $69,000 for baby boomers.

As such, Fleming believes the homeownership rate could well grow in the coming years.

“Higher income leads to higher house-buying power,” Fleming said. “Coupled with today’s 3.8 percent 30-year fixed-rate mortgage, 37-year-old millennials can afford $35,000 more home than Generation X and $52,000 more home than baby boomers at the same age. We expect the homeownership rate to further close the gap with potential in the years ahead as millennials continue to make important decisions, such as attaining an education and, later in life, getting married and having children.”