Fannie and Freddie regulator Edward DeMarco, the acting Director of FHFA, is taking a lot of heat for his reluctance to write down first mortgages for underwater homeowners. But DeMarco is rightly pointing out that the push to write down the first mortgages is merely a form of protectionism for the four largest banks in the U.S. - JP Morgan Chase, Wells Fargo, Citigroup, and Bank of America.

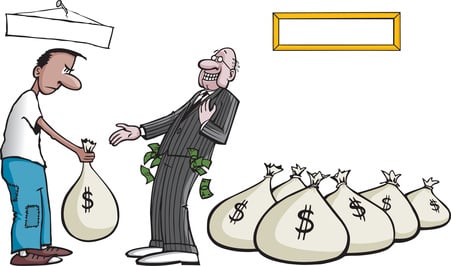

Laughing all the way to the bank - J.P. Morgan Chase, Citigroup, Wells Fargo and Bank Of America © Don Purcell - Fotolia.com

But aren't mortgage write downs beneficial for homeowners who are underwater?

What's really happening here is not an attempt to help homeowners who find themselves with too much debt on their homes. As DeMarco points out, writing down senior first mortgage balances held by taxpayer-backed Fannie Mae and Freddie Mac makes no sense, when you consider that many of these homes also have second mortgages that are held by the four banks named above. In fact, these four banks are holding almost 50% of all of the second mortgages in the U.S. housing market. This is a lot of money currently showing as assets on bank balance sheets. If the first mortgages are supposed to be senior to a second mortgage, then why aren't they considering writing down the second mortgages first?

Because the banks holding those second mortgages would be forced to realize a huge loss of asset value. Can you say "Bear Stearns"? This is exactly what happened to Bear when they collapsed in 2008. When the housing values began to collapse, taking the value of second mortgage paper with it, Bear Stearns saw it's asset value collapse.

So the real fact is that DeMarco is right to try and defend the U.S. taxpayers against this disguised attempt to circumvent first mortgage seniority. In essence, if you write down first mortgages owned by Fannie and Freddie, which are taxpayer backed, you are in effect, transferring more value to the second mortgages. The result is taxpayer paid losses to Fannie and Freddie, that simply increase the value of the second mortgages being held by the big banks.

The fact is, if the second mortgages were to be written down, it would benefit the homeowners and the taxpayers, but it would likely mean that the big four banks could lose an estimated $980 billion in second mortgages they are holding. These mortgages are arguably, almost worthless now that home values are no longer high enough to cover the outstanding mortgage debts.

When a home is foreclosed on, it is generally the second mortgage holder who gets wiped out. A principal reduction on the first mortgage may sound good to homeowners, but it's really just a way to transfer taxpayer assets away from the first mortgage and into the second mortgages, which would be left in place at their original face value.

Most homeowners do not realize that their second mortgages are also "recourse" loans, meaning that even if the house is foreclosed on, the bank holding the second can still sue the borrower to attempt to recover losses. Either way, homeowners who've lost property value would still be on the hook.

I strongly back Edward DeMarco on this one. I'd be willing to bet that he'll be ousted over this, so that the banks can protect their second mortgages at taxpayer expense. If this happens it will be yet another miscarriage of justice for the taxpayers, disguised as an attempt to help homeowners, when it's the big banks that will be the real beneficiaries.

If mortgage principal write downs are so important for some in the congress and the Obama administration, who are attempting to blame Mr. DeMarco for being an obstructionist, then it's only right to begin with the junior liens and let the second mortgage holders share in helping the homeowners, before sticking it to the taxpayers yet again, who are after all, in the first lien position. If the banks were the first lien holders, with Fannie and Freddie holding second mortgages, I'm quite sure this is what the banks would demand.

---------------------------------------------------------------------------------------------------------------

Donna S. Robinson is a 16 year veteran of the real estate industry and staff writer for Realty Biz News. An active real estate investor, she directs a team of industry experts who provide a wide variety of real estate investor services and training. You may join her email list on her website at www.RealtyBizConsulting.com

"When a home is foreclosed on, it is generally the second mortgage holder who gets wiped out" That's the theory, the reality is that it isn't true.

That's the reason of the "robosigning" case: banks were speeding up the foreclosure process to protect their 2nd liens held into their balance sheets at near face value in held-to-maturity portfolios.

The politicians protecting the big banks again.

The politicians-bankers linkage is the disease of the world.

Great article.