Government sponsored enterprise Freddie Mac failed in its bid to meet its low-income housing goals for 2017, according to a new report from the Federal Housing Finance Agency published this week.

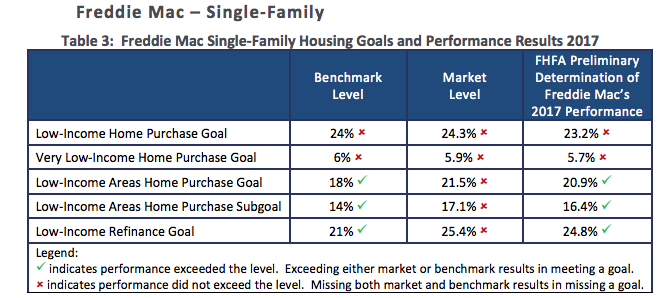

In the report, the FHFA lays out a benchmark level and a market level for each of the low-income housing goals for both Freddie Mac and Fannie Mae. If both of the levels are missed, then it’s deemed to have failed to meet that goal. In the case of Freddie Mac, it missed goals for both low-income home purchases and very low income home purchases.

The following chart shows how Freddie Mac performed with respect to its goals in 2017. It failed completely on two of its goals, and also failed to meet the market level on all five goals:

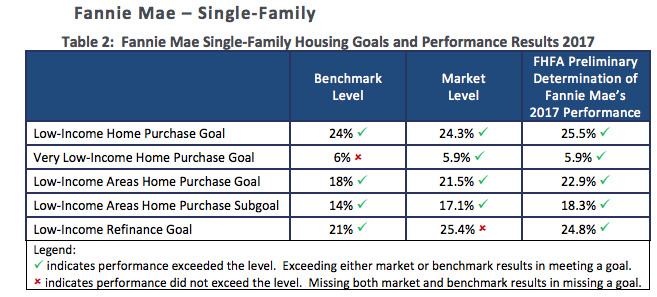

On the other hand, Fannie Mae managed to achieve all of its low income housing goals. It did however miss its target on the benchmark level for very low income purchases, and the market level for its low income refinance goals.

The FHFA has yet to publish its final determination while it waits for any possible responses from Freddie Mac and Fannie Mae.

Both enterprises are bound by the Safety and Soundness Act to serve very low, low and moderate income families in three underserved markets, namely manufactured housing, affordable housing preservation and rural housing. The idea is to increase the liquidity of mortgage investments and improve the distribution of investment capital for mortgage financing in each of those markets.