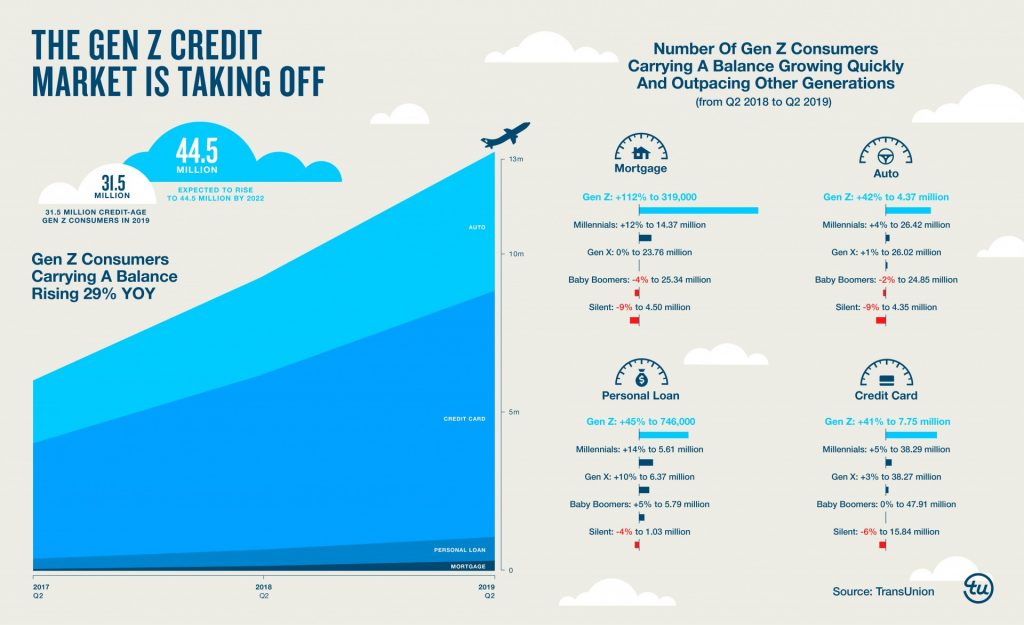

Generation Z is finally coming of age, with around 14 million consumers born during or after 1995 taking out credit, including mortgages, according to data from the credit firm TransUnion.

In its Q2, 2019 Industry Insights report, TransUnion said that both the newest and the oldest members of “credit-eligible” Gen Z’ers are beginning to enter the credit market.

“The rapid growth in Gen Z credit activity is occurring despite many of these individuals having grown up during the Great Recession,” said TransUnion’s vice president of research and consulting, Matt Komos. “Though the recession itself landed less than two years, its impact was felt for several years afterward. As we see more members of this group come of age, we naturally expect continued growth in credit activity by Gen Z.”

The most popular type of credit among Gen Z members at present is the trusty old credit card, but a growing number are also taking out mortgages for the first time. Indeed, mortgages among Gen Z’ers saw a 112% spike in the last year, according to TransUnion’s data. Of course, this growth came from a very low base, and people in this generation account for just 0.5% of mortgages in the U.S. overall.

But Gen Z is showing more eagerness to get into homeownership than previous generations at the same age. According to another report from the Bank of America released earlier this year, around half of Gen Z’ers aged 18 to 23 say they’re already saving for a home, and 59% want to buy one within the next five years, before they reach the age of 30. In addition, 71% of the nearly 2,000 people surveyed also said they already know exactly what they want in their future home.

“It’s exciting to see Gen Z wanting to own a home for reasons like building their personal wealth over time,” said Steve Boland, head of consumer lending at Bank of America. “Despite their young age, this group is pragmatic and actively planning for their future. They recognize buying a home isn’t easy and have a clear vision not only about where they plan to get help but also how they are willing to help themselves in order to make it happen.”