Experts say that home buyers don’t necessarily need an 800+ FICO score in order to be guaranteed the best rates on their mortgage. These days, some buyers in the 700 FICO score range can also secure the most attractive rates, according to a new analysis of one million loan offers by Lending Tree that was first reported by the Washington Post.

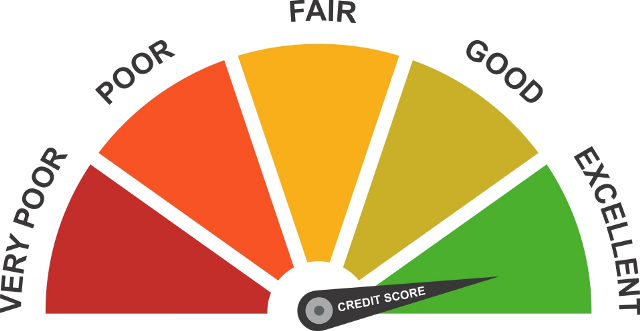

Most lenders use FICO scores, which range from 300 to 850, in order to assess the risk that each borrower poses. The general rule is that the higher the score, the less chance of defaulting. As such, lenders are happy to offer lower rates to those who’re most likely to be able to pay off their mortgage.

As an example, a borrower with a FICO score of at least 760 at the time of writing would be able to secure a rate of 4.14 on a $300,000 fixed-rate 30-year mortgage. But someone who only has a FICO score of 620 would be quoted a rate of 5.73 percent for the same amount.

That’s according to the traditional rules anyway. But Lending Tree analysts say that the difference is becoming less pronounced. In its analysis it found that borrowers with a credit score of between 670 and 679 who made a 5 percent down payment received an average quote of 5.2 percent. But borrowers with a credit score of more than 800 with the same 5 percent down payment were only receiving offers averaging 4.78 percent, which is a much smaller difference than in the past. Lending Tree’s analysis showed that gap between quoted interest rates is narrowing for those who provide 20 percent and 25 percent down payments too.

“Although scores and down payments are indeed crucial risk components that factor into a lender’s offer, market conditions and competition also can affect the size of rate benefits to lower-FICO borrowers compared with high-FICO borrowers,” said Ken Harney, a national real estate syndicated columnist for The Washington Post. “In actual application situations, lenders who want to increase their loan business to home buyers may dig deeper into the credit pool and offer relatively more attractive rate deals to people whose scores are not pristine.”

Tendayi Kapfidze, LendingTree’s chief economist, told the Post that this was likely due to a more challenging market for lenders in 2018 as demand for refinancings shrunk. They looked to be more competitive to attract more home purchase applications.