Homeowners who’ve taken out a mortgage to pay for their home have benefited from rising home values, seeing an average 12.2 percent year-over-year increase in equity, according to new research from CoreLogic.

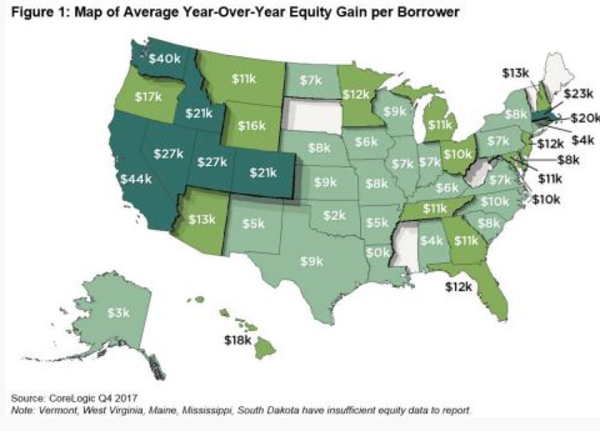

The analyst firm’s newly published Home Equity Report looks at the fourth quarter of 2017, and found that homeowners gained an average of just over $15,000 in home equity in one year. That represents the highest growth in home equity for four years, with western states seeing the biggest increases.

Frank Nothaft, chief economist at CoreLogic, said that home price growth has been the main factor behind the increase in home equity. “Because wealth gains spur additional consumer purchases, the rise in home-equity wealth during 2017 should add more than $50 billion to U.S. consumption spending over the next two to three years,” he said.

Also encouraging is that the number of borrowers who have negative equity is declining. CoreLogic said the total number of homes with a mortgage in negative equity – which means borrowers owe more on the home than its current value – fell to just 2.5 million homes. That’s just under 5 percent of all mortgaged homes in the U.S., CoreLogic said.

However, Frank Martell, president and CEO of CoreLogic, said that wide disparities remain with home equity gains, depending on the geographic area. The biggest gainers have been homeowners in the fast growing East and West coast markets, he said. For example, homeowners in California and Washington have seen their wealth increase by around $40,000 on average.

“In contrast, the average owner in Louisiana had little change in their housing wealth during 2017, given much lower prices and modest price growth,” Martell said.