Disappearing inventories are pushing home prices up at a rapid pace in almost all major metro areas, according to the National Association of Realtors.

The NAR said in its latest quarterly report that the national median existing single-family home price hit $254,000 in the third quarter, up 5.3 percent from the same period one year before.

Home prices accelerated in 92 percent of the 177 major markets the NAR measured over the last quarter. Of these, 19 metros saw double-digit increases, while just 15 metros saw median prices fall.

“The stock market’s climb to new record highs, the continued stretch of outstanding job growth, and mortgage rates under 4 percent kept home buyer demand at a very robust level throughout the summer,” said the NAR’s chief economist Lawrence Yun.

Yun explained that housing prices were rising due to a lack of new properties coming on the market.

“Unfortunately, the pace of new listings were unable to replace what was quickly sold. Home shoppers had little to choose from, and many had outbid others in order to close on a home,” Yun said. “The end result was a slowdown in sales from earlier in the year, steadfast price growth, and weakening affordability conditions.”

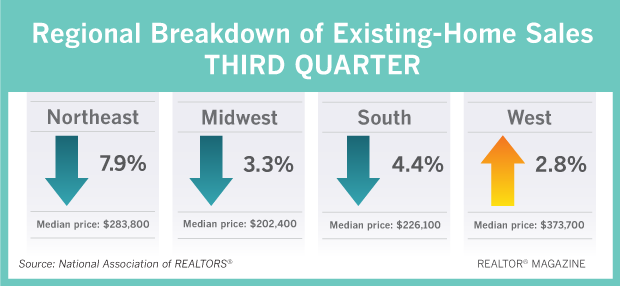

Homes are becoming unaffordable because prices exceed incomes in several parts of the U.S., particularly in the South and West regions, the NAR reported. In those area, new home construction is also constrained when compared to job growth.

At present, for an individual to purchase a single-family home at the national media price with a five percent down payment, they would need an income of $55,142. For a 10 percent down payment they would need to earn $52,240 per year, while a down payment of 20 percent requires earnings of at least $46,435 per year.

According to the NAR, there were just 1.9 million existing homes available for sale in the U.S. at the end of the third quarter, down 6.4 percent from a year ago.