The gap between homeowner's perceptions of their properties' value and what appraisers say their homes are actually worth is growing bigger, according to the latest Home Price Perception Index from Quicken Loans.

The Quicken Loans HPPI represents the difference between appraisers’ and homeowners’ opinions of home values. The index compares the estimate that the homeowner supplies on a refinance mortgage application to the appraisal that is performed later in the mortgage process.

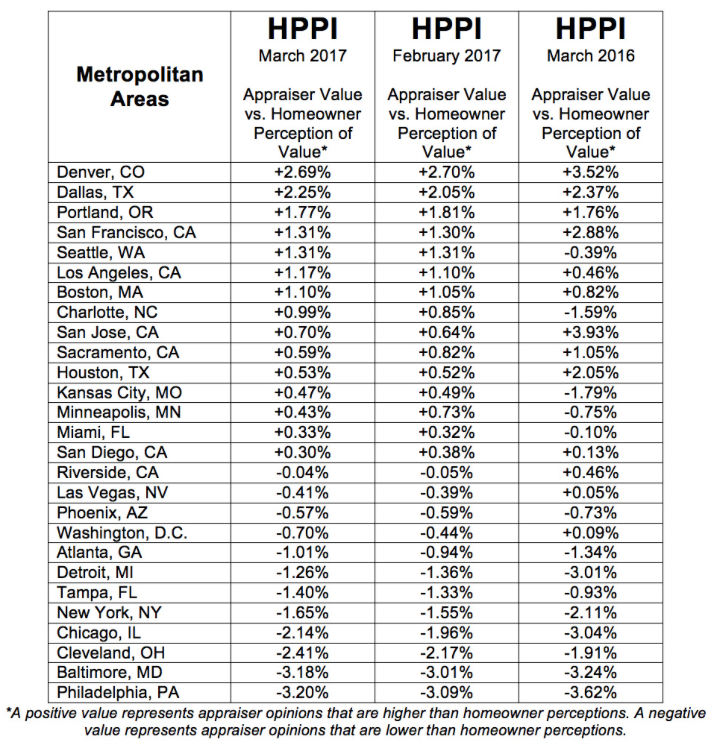

The new index shows that appraisers' valuations were on average 1.77 percent lower than the value homeowners put on their properties. That's the fourth successive month in which the gap between homeowner estimates and appraiser's views has grown, Quicken Loans said.

However that's not true of all markets. In some of the country's hottest real estate markets, such as the San Francisco Bay area and other west coast areas, appraisers are still estimating higher values than homeowners themselves.

Bill Banfield, Quicken Loans’ vice president of Capital Markets, said it can be difficult for some homeowners to keep up with the latest price trends in fast-moving markets. "With prices sprinting forward in many of the booming housing markets in the West, it can be difficult for homeowners to keep up with appraisers, who are on the ground, examining real estate price changes every day," Banfield said.

Quicken Loans advises consumers to keep up to date with the prices of similar home listings in their area before they list their home or apply for refinancing, as the state of the market could have a big impact on their home's value.