Female buyers often need greater reassurance than men when it comes to completing real estate transactions, a new study has found.

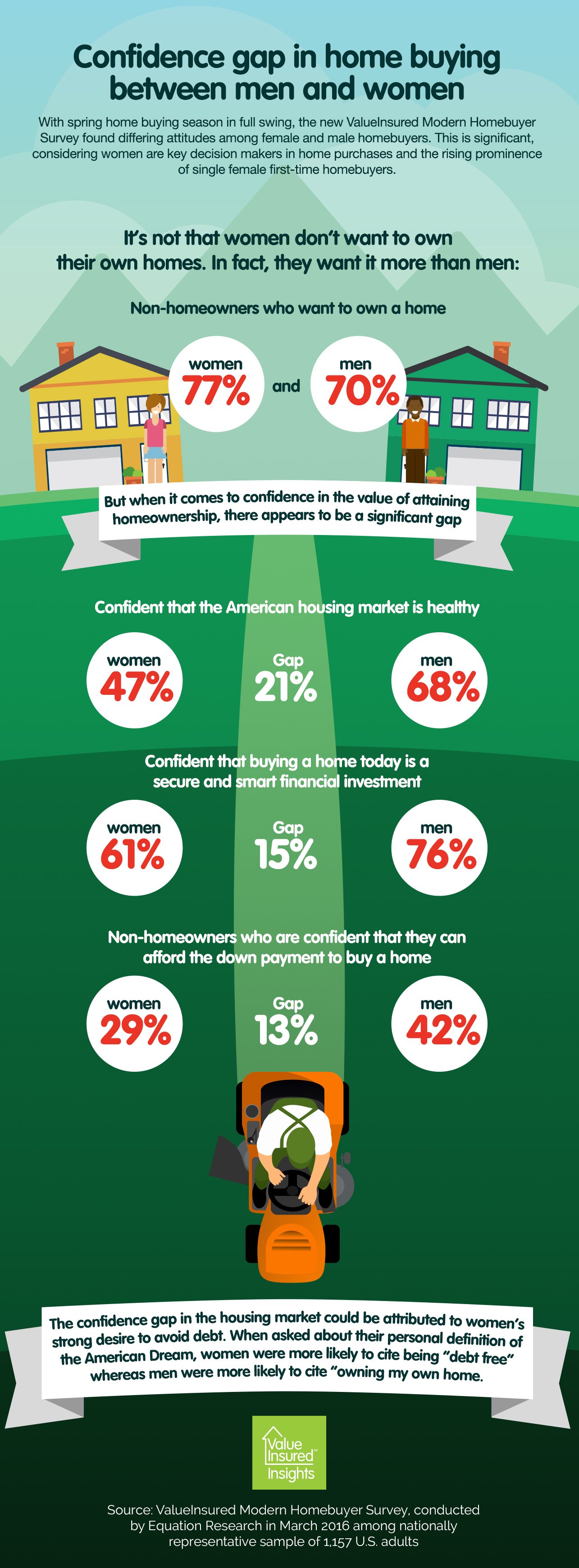

ValueInsured’s Modern Homebuyer Survey believes its uncovered what it calls a “housing confidence gap” between men and women. It says that although women often have a greater desire to buy than men, they’re also much more hesitant to sign on the dotted line. Indeed, some 77 percent of women who don’t own their own homes want to buy, compared to just 70 percent of non-homeowner men.

However, women generally have less confidence in the health of the real estate market (47 percent of women vs 68 percent of men), and they’re less confident that buying property is a sound financial investment (61 percent vs 76 percent). Also, non-homeowner women are less than sure of their ability to afford the required down payment on a home (29 percent vs 42 percent).

ValueInsured’s survey shows men are more confident when it comes to selling too. More men revealed they believe they can recoup the full amount they paid for their home when it comes to selling, than women. Additionally, greater numbers of men (83 percent) than women (74 percent) said they’d like to upgrade to a better home when they sell their current property.

Researchers say that the survey findings can be put down to a general tendency in women to be more “debt-averse” than men. For instance, more women cited being “debt-free” as one of their definitions on the American Dream than men. Their male counterparts were more likely to cite “owning my own home”.

“Understanding these differences in attitudes will help make this year’s home buying season successful for both sellers and lenders,” Joe Melendez, CEO of ValueInsured, said in a statement. “The numbers highlight the need to ensure that all buyers, and especially women, know about the new ways they can protect their hard-earned investments when buying a home.”