If you're unlucky enough to live in San Francisco, you'll be all too aware just how expensive it is to buy a home in the area. The only bright spot is that, San Franciscans tend to make pretty decent salaries, but does that help to make up for the premium they have to pay on real estate?

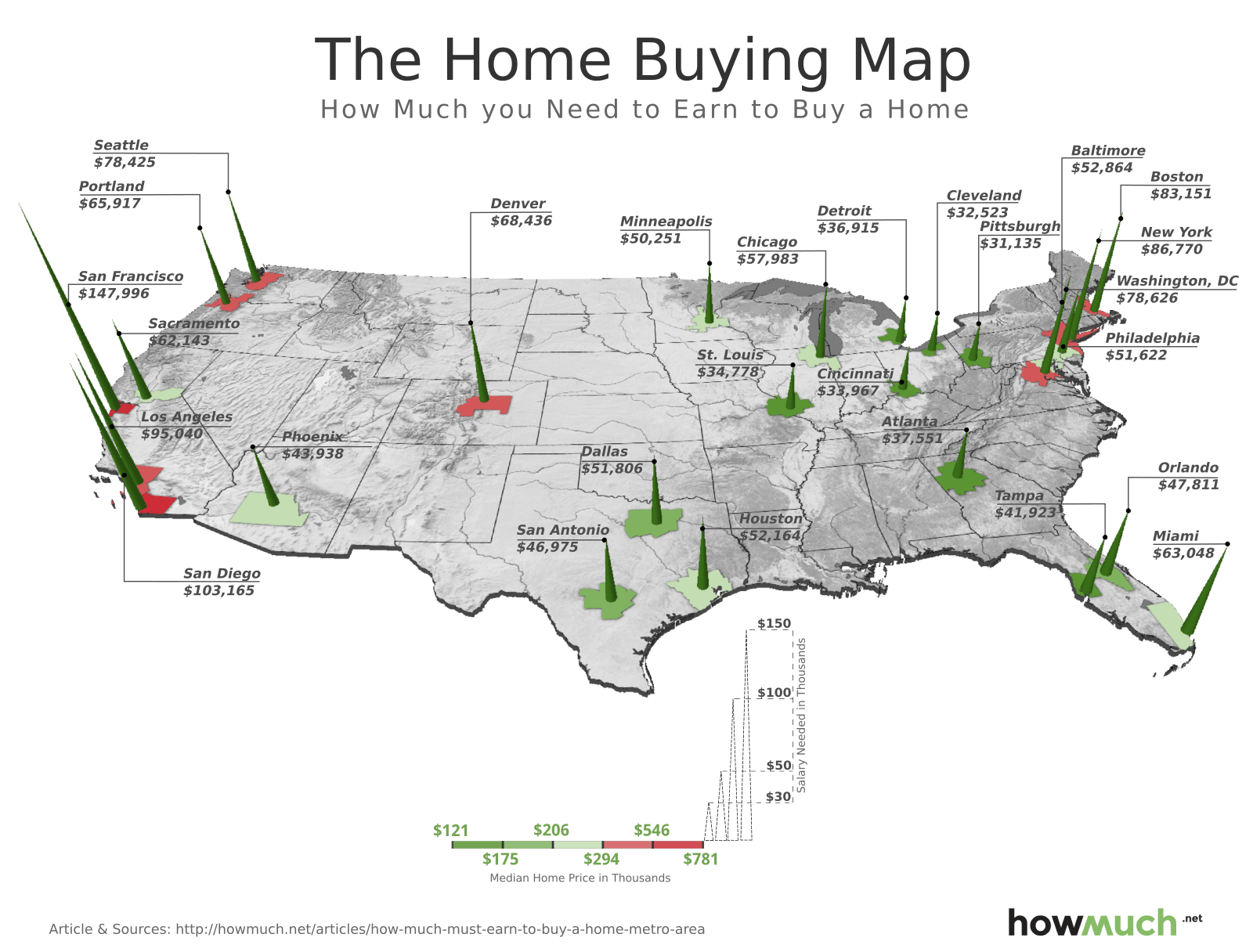

Well, thanks to HowMuch.net, which used National Association of Realtors' pricing data to calculate housing costs, we now know exactly how much one needs to earn to be able to buy a home in the area they live. And for many who live in San Francisco, it probably isn't good news to learn that you'll need a minimum salary of $147,996 a year in order to be able to buy a home that sits in the city's median price range at $781,600.

Out of 27 major metros analyzed by the site, San Francisco requires the highest salary in order to pay for the mortgage principal, interest, taxes, and insurance payments on a median-priced home, HowMuch found. In contrast, prospective buyers in Detroit need a salary of just $36,915 a year to be able to afford the median home price of $148,667 in the city.

The map shows that homebuyers who live in the West need the highest salaries to be able to afford a home, while those in the Midwest and the South have it easier.