With Hurricane Florence closing in on the Carolinas and Virgina this weekend, threatening storm surges and destructive winds of up to 130 mph, experts are warning that more than 750,000 homes are at risk of serious damage.

Florence is set to bring with it widespread inland rainfall and flooding in addition to strong winds, with experts saying it could potentially be one of the most devastating storms to hit this part of the East Coast. Damages from the storm are forecast to cost as much as $170.2 billion, experts told CNBC.

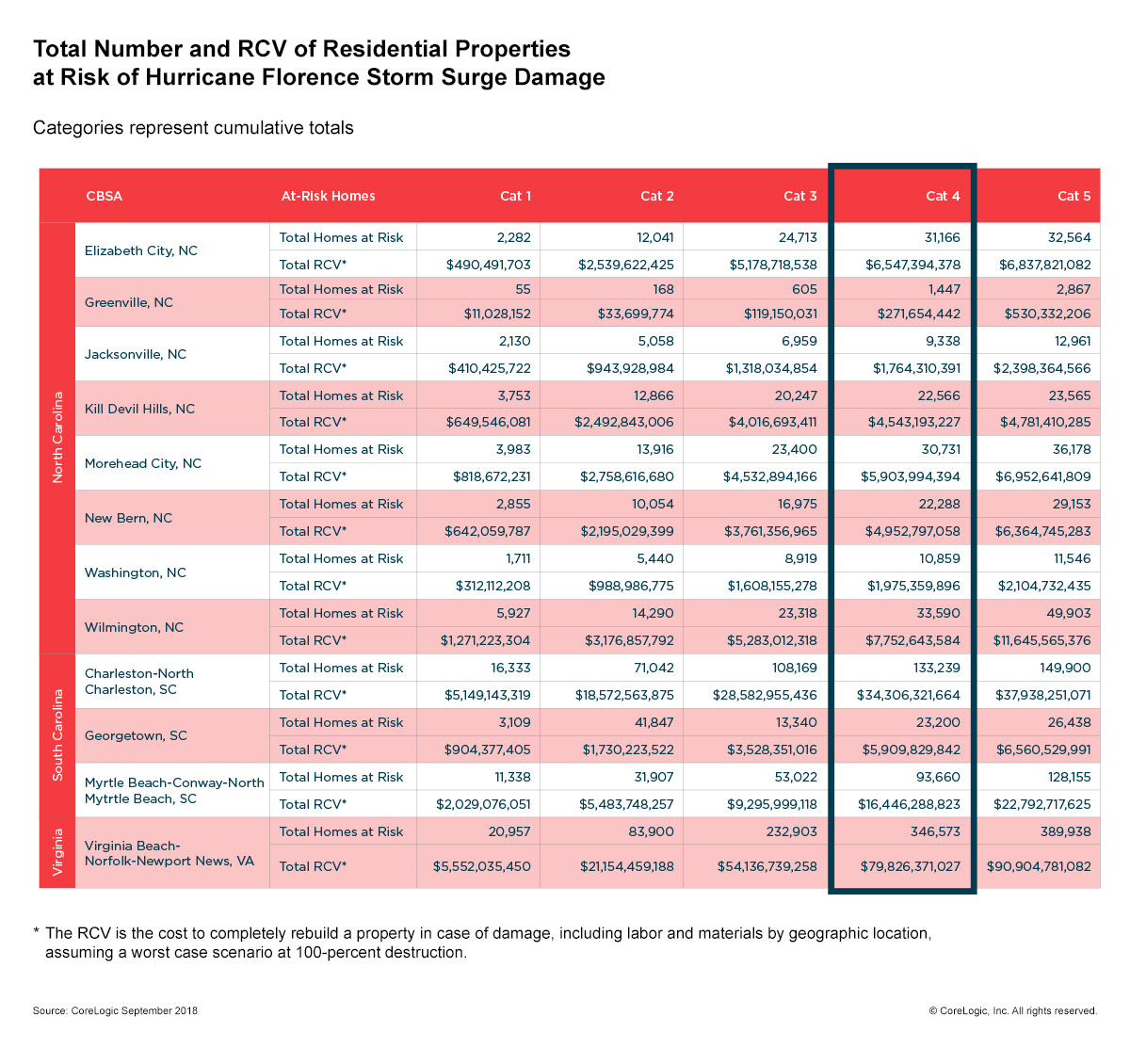

Real estate data analysis firm CoreLogic has published the following table depicting the number of properties at risk of storm surges, for each of the five hurricane categories:

Homeowners who’re located in the projected path of Florence likely won’t be able to make any insurance changes at this late stage, but experts are urging other homeowners just outside of its path to check on their insurance now. The hurricane season runs from June 1 to November 30, and experts are predicting a fairly active one this year.

Last year, the U.S. was hit by three major storms, Hurricanes Harvey, Irma, and Maria, which caused a combined $265 billion in damages.

“Most people fail to read their [homeowners] insurance contract to understand what’s covered and what’s not, and then they’re surprised after an event when they discover they didn’t have the coverage,” Lynne McChristian, a consultant to the Insurance Information Institute, told CNBC.

Insurance experts advise ways to prepare: homeowners in hurricane-prone areas can make sure they have coverage through the federal National Flood Insurance Program or a private insurer for flood insurance; check deductibles; check renters' insurance if applicable to cover their belongings; and safeguard documents (keep all insurance policies, title to your car, birth certificate, and so on in a fire- and flood-proof lockbox or a safe deposit box at a bank).