Fifth Wall Ventures has raised $503 million for investing in PropTech companies, according to an announcement last week. The Los Angeles firm that financed the likes of OpenDoor and VTS, attracted both domestic and international capital in this round.

Investors in this fund include CBRE, Cushman & Wakefield, Equity Residential, Marriott International, and Starwood Capital. The fund, which is more than twice the amount Fifth Wall raised back in 2017, also includes investment from Spain, the UK, Japan, and Singapore.

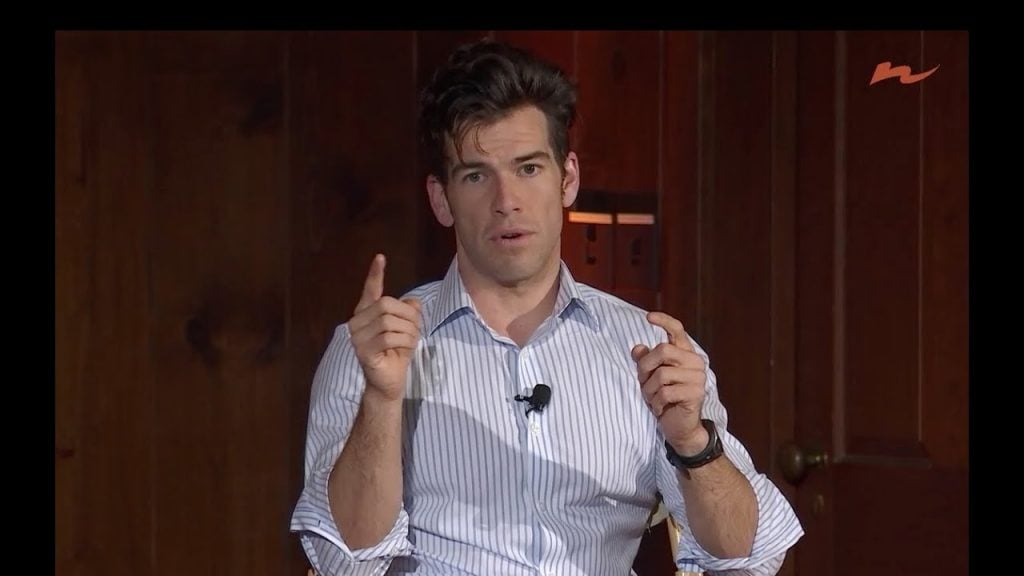

Back in 2017, VCs sunk over $12.6 billion into real estate technology companies, followed in 2018 by an additional $9.6 billion. With the recent investment of over $200 million in hospitality start-up Sonder, ProTech is not only seeing big series funding, but the sector has broadened to include the hospitality space. Fifth Wall co-founder and managing partner Brendan Wallace commented on the news:

“Fifth Wall sees powerful network effects in our unique fund model as it becomes a centralized platform for the world’s largest real estate companies to share insights and access new technologies to enhance their businesses,” Wallace said in a prepared statement. “For our entrepreneurs, Fifth Wall efficiently opens distribution channels for their products to more than 50 corporate strategic investors globally.”

Fifth Wall has roughly $1 billion under management and has grown from eight employees in 2017 to 30 today, according to the release. Fifth Wall Ventures is also an investor in Clutter, b8ta, ClassPass, Lime, and others.

In related news, Cushman & Wakefield also selected Fifth Wall as a technology partner. The Chicago-based services firm, a Fund II investor, also recently entered a technology relationship with Saltmine.