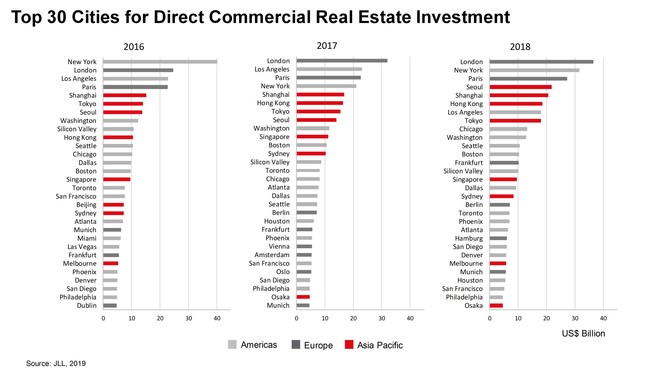

According to a report from Jones Lang LaSalle (JLL), London remains the largest commercial real estate investment market in the world. The report frames how investors still show confidence in gateway cities, especially in well-established markets with transparency.

Despite the good news for these gateway cities, JLL projects 2019 investment volume will fall short of 2018 totals because of investor concerns over Brexit and other political uncertainties. The following list of the top 30 cities for direct commercial investment shows the current state of affairs.

According to JLL, large gateway cities with the world's deepest concentrations of capital, companies, and talent go on dominating the rankings. The chart above reveals twelve cities–London, New York, Paris, Seoul, Hong Kong, Tokyo, Shanghai, Washington DC, Sydney, Singapore, Toronto

JLL now predicts the 2018 momentum will be carried over into 2019 owing to the stability of real estate as compared to other types of investments even though yields are at historic lows. This prediction mirrors news from other sectors where confidence in the overall economic outlook is negative to mixed. That said, JLL also predicts overall investment volumes will fall approximately 5 to 10 percent below the 2018 total.

The overall softening of the worldwide market can be seen from keying on the luxury segment where experts anticipate uncertainty coming from high net worth investors. Liam Bailey, global head of research at Knight Frank was just quoted by Mansion Global as saying:

"The property cycles of first-tier world cities are more in sync as their financial markets have become more integrated. Low interest rates, greater institutional investment and rising wealth have left their mark on most prime markets, but it also means policy responses in one market may have broader ramifications globally."

Frank's logic is sound, and his insinuation that sub-markets within these gateway cities are the smart