A large number of homeowners have expressed regret that they missed out on the 2020 refinancing wave, which saw many take advantage of record-low interest rates to reduce their monthly mortgage payments.

A new survey from LendingTree found that 36% of homeowners who missed the chance to refinance say they regret not doing so.

Many admitted that they missed out due to a lack of knowledge about what refinancing is and what it entails. For instance, some said they falsely believed they had to work with their original lender to refinance, or that it was only possible to refinance once. Some 11% said they don’t even know what their current mortgage rate is and whether or not they could benefit from refinancing.

The most common demographic to take advantage of refinancing last year was millennials. Around 42% of people in that bracket did take the opportunity to refinance, compared to just 18% of Generation Xers and 10% of baby boomers.

That said, many homeowners still have an opportunity to take advantage of refinancing. That’s because mortgage rates still remain low, even though they have increased slightly in the last couple of months.

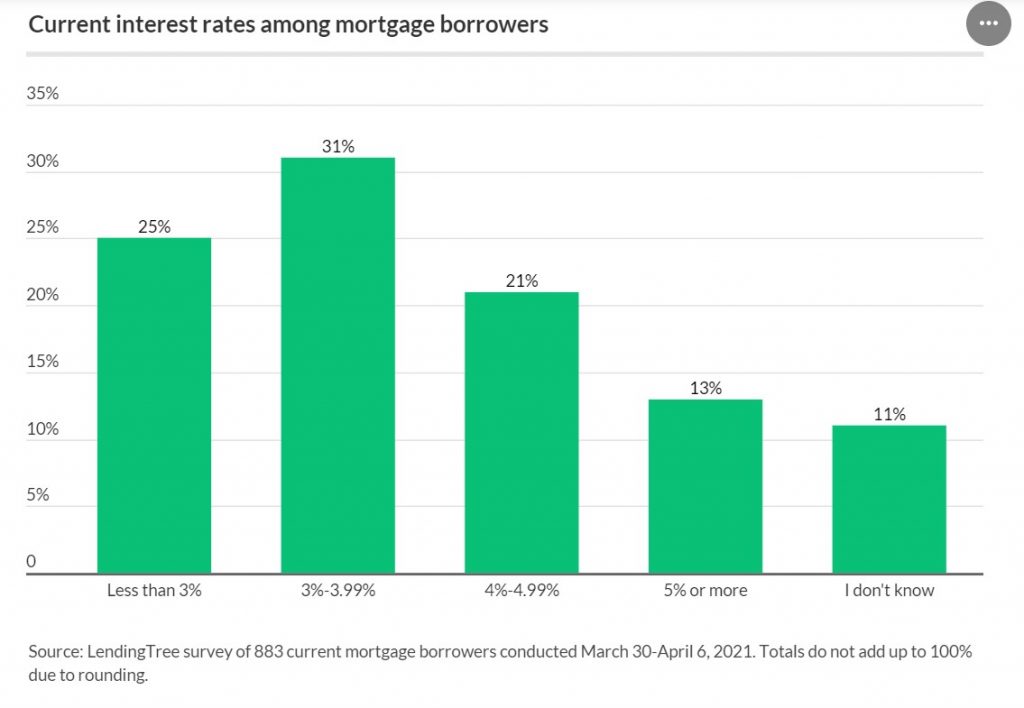

Last week, Freddie Mac said the 30-year fixed-rate mortgage averaged 2.98%, which is still much lower than traditional levels. That could benefit the 34% of homeowners who said they have a mortgage rate of 4% or higher, LendingTree said. Those people could potentially save thousands of dollars over the lifetime of their loan if they refinance now. The message appears to be resonating, with around 49% of homeowners surveyed by LendingTree saying they are considering refinancing within the next 12 months.

It’s worth noting that there was some good news recently for lower-income homeowners too. Last week, the Federal Housing Finance Agency announced plans for an upcoming program for low-income homeowners with government-backed mortgages to refinance at a lower rate. That plan is set to launch by the summer, and could help low-income borrowers save between $100 to $250 per month on their loan repayments, the FHFA said.

That said, homeowners need to consider the disadvantages of refinancing too. One of the main considerations is that refinancing often results in a new, 30-year term mortgage, which means borrowers could end up paying more over the long term, even if their monthly payments are reduced. Refinancing also comes with closing costs, and usually results in a reduced credit score.