An innovative PropTech company that creates 3D spatial mapping tools, Matterport will now go public through a merger with Gores Holdings VI - GHVI (NASDAQ). The new ticker symbol "MTTR" will see the niche startup weigh-in for possible big returns in a “next” environment. Here’s a smart look at trending technology that may bust open the way agents optimize revenue.

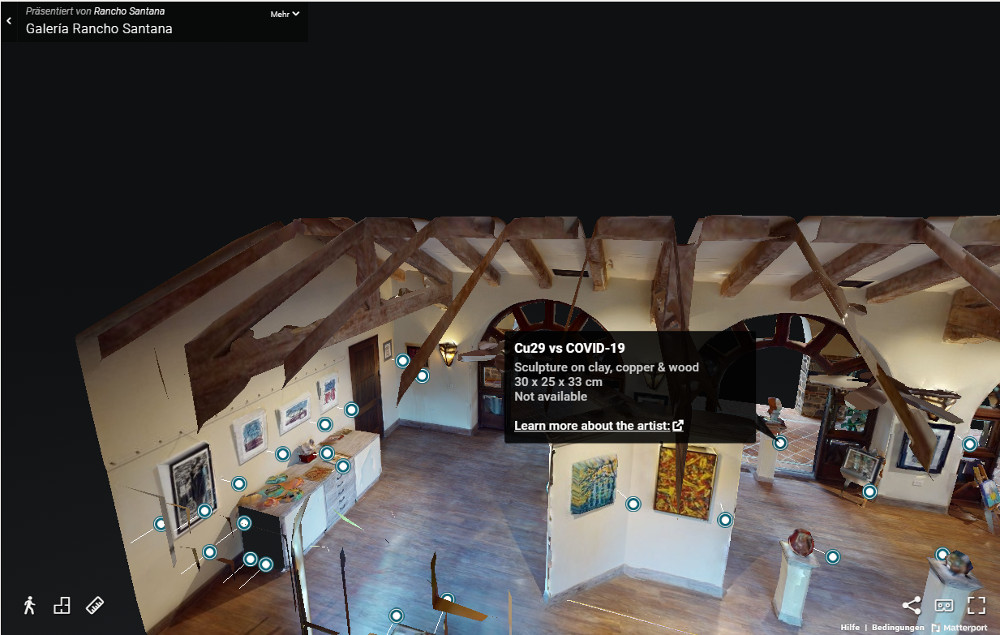

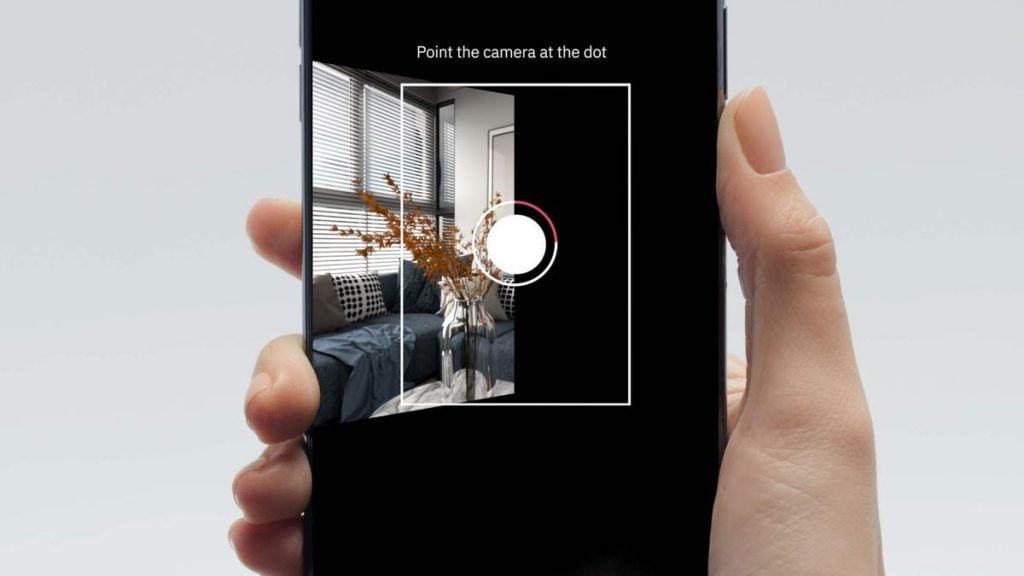

Matterport, for those unfamiliar, is a 2011 startup that initially sold 360-degree cameras for creating virtual tours and developed cloud-based software for converting 2D images into 3D spaces. The service has subsequently launched an iOS app that streamlined the process by enabling iPhone and iPad users to scan physical spaces and to create cool 3D models to help realtors offer more immersive virtual tours.

Matterport has already been used to recreate models for millions of buildings worldwide, and the company has more than a quarter-million customers today. The service’s growth potential would seem endless given the changes the COVID-19 pandemic has superimposed on renters, buyers, agents, and other stakeholders in the real estate game. However, Matterport's service is pricier and more complicated than those competitors like Zillow's 3D Home Tour and Cupix 3D Tour.

The big win for Matterport will probably come from the need for virtual reality being brought into the built world, and not only as a result of pandemic remoteness trends. The company already has an edge on market leadership via the ability for deploying IoT (internet of things) diverse use cases, and datafication capability. But what gives the company its biggest leg up is the fact the real estate industry, despite its size, is one of the slowest where technological integration is concerned. You see, the biggest reason real estate businesses have not kept up with the curve, is the difficulty in integrating these new tools. Matterport conquers this space by offering a virtual tool made tailor-made to integrate with the built world.

To give you an idea of the potential, the Ark Invest report “Big Ideas 2021” puts potential revenues from such virtual ideas at about $400 billion by 2025. Of course, the pandemic has helped push virtual world importance because of limitations on offline activity, accelerating an already existing trend. In addition, Matterport’s simplicity does not hurt its potential either.

Founded back in 2011 the startup quickly established itself as the market leader in the spatial data category by transforming physical spaces into interactive 3D digital clones of these real spaces. Matterport customers just scan their spaces with a compatible camera or iPhone, and Matterport’s learning software laces a series of photos together to create a robust and very accurate 3D copy of the property scanned. Cortex AI, the core of Matterport’s technology, lets customers publish the 3D model on social media, embed it on a website, or integrate it into other platforms.

It’s drop-dead simple when all is said and done. And the use cases are almost unlimited. Airbnb, agents, big hotel chains, property management businesses, and even insurance adjusters are using the technology already. And finally, the next versions of this technology may even allow for instant appraisals of properties. So, as you can tell, the Gores stock has a lot of interest right now too. Motley Fool’s Millionaire Acres discusses the potential of digital twins here, and especially the more far-reaching implications. As for my take, I may be investing in the market for the first time ever, after I post this.